WorldRemit is one of the most prominent players in the international money transfer industry. They’ve been active for over a decade and managed to clearly differentiate their brand from the fierce competition.

As with all money transfer providers, clients can use WorldRemit to send money to other people in over 145 countries worldwide. Besides their overall ease of use, convenient rates and fees, and excellent safety features, this company is one of the few that offers cash pickup and home delivery services.

So, whether you’re sending money to your cousin in South Africa, your friend in France, or your accountant in Canada, you can consider WorldRemit as a safe, reliable choice to do so. But what sets them apart from their competitors? We’ll discuss that in this thorough review.

Below, we’ll go over their background, pros and cons, features, rates and fees, safety, speed, customer service, customer reviews, alternatives, and how they stack up against the competition. Let’s begin!

Who are WorldRemit?

WorldRemit is a London-based online money transfer firm launched in 2010 by Ismail Ahmed, a Somali-born economist who sought to make international money transfers more reasonable and accessible. Before he gave rise to WorldRemit, Ahmed gathered valuable experience working for the United Nations, the World Bank, and other international organizations.

WorldRemit has developed fast since its beginning, becoming one of the most successful and renowned companies in the global money transfer market. The firm has garnered various awards and honors, including being voted the Best for International Transfers among the Best Money Transfer Apps by Investopedia in 2023.

WorldRemit’s success may be credited to its dedication to providing a simple and cost-effective solution for customers to transfer funds abroad. They’ve made a name for themselves by providing transparent and cheap pricing with no hidden charges or expenses. They have also made significant investments in their technology sector to guarantee that their platform is user-friendly, safe, and trustworthy.

Today, WorldRemit has a global presence, with services available in more than 145 countries, while enabling millions to send money to family and friends all over the world. They have also extended their offerings to include mobile wallet transfers and cash pickups, making it even easier for users to move money in the most convenient manner.

In the field of international money transfers, WorldRemit is a business with a clearly-defined mission and a successful track record. Everyone who needs to send money overseas frequently chooses them as they represent a symbol of transparency, affordability, and efficiency.

WorldRemit Pros & Cons

| Pros | Cons | |

|---|---|---|

| 1. | A plethora of payment options – WorldRemit has many options people can choose from to fund their money transfers. They include bank account, credit/debit/prepaid card, Apple Pay, POLi, Interac, iDEAL, Trustly, and Klarna/SOFORT. | Not suitable for large money transfers – WorldRemit is designed to facilitate small and frequent money transfers to friends and family who live abroad. |

| 2. | Favorable exchange rates – WorldRemit’s exchange rates are often better than those offered by other competing money transfer companies and certainly better than traditional banks – 1% to 1.5% markup on average. | No dedicated account managers – Some money transfer services offer dedicated dealers for every customer to manage their accounts and help with every money transfer. WorldRemit lacks this feature. |

| 3. | Low transfer fees – WorldRemit’s transfer fees are always low and fixed and vary depending on the amount being sent, the origin and the destination country, and the payment method selected – ranging from $0.99 to $3.99. | Average Trustpilot rating – With a 3.9-star rating, there are many money transfer providers with a higher rating than WorldRemit. |

| 4. | Great cancellation policy – Bank transfers and mobile money transfers can be canceled even after they’ve been paid out if the recipient of the money consents to the cancellation. | No business options – As WorldRemit isn’t optimized for large money transfers, they don’t offer business solutions such as forward contracts and limit orders. |

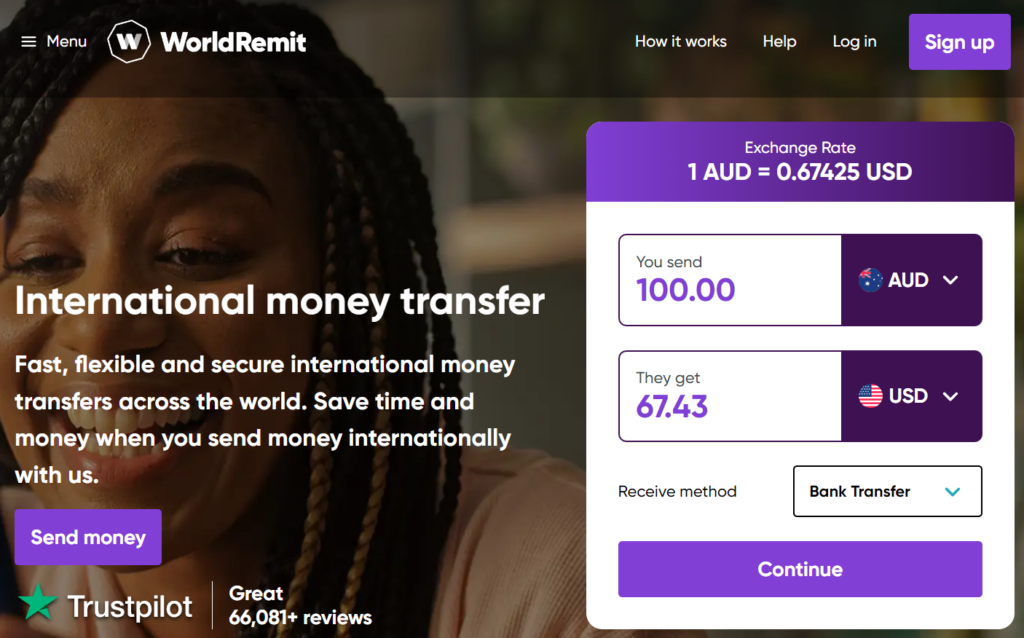

| 5. | Instant custom quotes – WorldRemit allows visitors to obtain an instant custom quote using the rate calculator on their homepage. They don’t require users to sign up for an account to get a quote. | Many negative reviews regarding customer service – Online customer reviews sometimes refer to WorldRemit’s customer service as slow in their response times. |

| 6. | Cash pickup service – WorldRemit allows clients to make money transfers that can be collected in cash by their recipient at a designated pickup location. | |

| 7. | Mobile money feature – WorldRemit offers this convenient option for customers to transfer mobile money (digital wallet) as a way to lower fees and speed up the transfer process. | |

| 8. | Global service coverage – With WorldRemit, residents from 50 countries can send money to friends or family located in more than 145 countries from around the world. | |

| 9. | Solid currency coverage – WorldRemit boasts support for over 70 different currencies, many of which are exotic African currencies. | |

| 10. | Local coverage – WorldRemit has offices in 15 countries across all continents except South America. | |

| 11. | Fast money transfers – WorldRemit processes 95% of all transactions within minutes. The rest are delivered in 0 to 2 business days. | |

| 12. | Extensive knowledge base – WorldRemit features an extensive online help center with a wide range of topics designed to help customers find a quick solution to any arising issues. |

WorldRemit Key Attributes

- Founded: 2010

- Headquarters: London, UK

- Other offices: WorldRemit is spread out over 15 countries across all continents except South America. Their offices are located in Poland (Krakow), USA (Denver), Philippines (Cebu), Australia (Sydney), Belgium (Brussels), Japan (Tokyo), Kenya (Nairobi), Malaysia (Kuala Lumpur), Rwanda (Kigali), Singapore, South Africa (Johannesburg), Somaliland (Hargeisa), Tanzania (Dar Es Salaam), Uganda (Kampala), and Canada (Toronto);

- Annual trading volume: WorldRemit facilitates over 1.5 million transactions every month which results in about $10 billion in money transfers on an annual level. In 2021, the company’s revenue was $399.4 million;

- Number of employees: Growing larger every year, WorldRemit listed that their employee number for 2021 was 1,766 across all their offices;

- Trustpilot rating: WorldRemit boasts almost 70,000 customer reviews on Trustpilot where their overall rating is 3.9 out of 5 stars (February, 2023). While there are a few providers with higher ratings, a 3.9 is still considered a solid rating in the money transfer industry;

- Number of clients: According to WorldRemit, their growing customer base has over 5.7 million numbers;

- Available countries: There are over 50 countries from which you can send money to friends or family with WorldRemit. Overall, residents from those countries can make money transfers to more than 145 countries from around the world;

- Number of currencies: WorldRemit is quite suitable for sending money to many African countries since they support many currencies that circulate in the region. Overall, the company boasts support for over 70 different currencies;

- Minimum transfer limit: Customers that use WorldRemit don’t need to worry about how small their money transfer needs to be as the company allows the sending amount to be as low as $1 (or currency equivalent);

- Maximum transfer limit: With WorldRemit, there are different maximum transfer limits depending on the selected countries and the method of payment. Given that, WorldRemit’s maximum transfer limit can range from about $1,400 to about $60,000. For example, customers in South Africa can make a money transfer of a maximum of $1,400, those in the US can send up to $9,000 in a single transfer, and UK residents can send up to £50,000 with one transaction;

- Transfer fee: WorldRemit has one of the lowest transfer fees which are always fixed and depend on the transfer amount, the selected countries, and the method of payment. Given that, WorldRemit’s transfer fees can range from $0.99 – $3.99;

- Exchange rate markup: We’ve tested many different transfer samples and discovered that WorldRemit adds about 0.5% – 2.5% profit margin on the mid-market exchange rate. This markup depends on the amount of the transfer and the countries involved in it. On average, WorldRemit customers can expect an exchange markup ranging between 1% to 1.6% to be added to their total currency exchange difference;

- Sending money through: Depending on where customers are from, WorldRemit allows a ton of options people can choose from to fund their money transfers. They include bank account, credit/debit/prepaid card, Apple Pay, POLi (Australia and New Zealand), Interac (Canada), iDEAL (the Netherlands), Trustly (Austria, Denmark, Estonia, Finland, Germany, Italy, Norway, Spain, and Sweden), and Klarna/SOFORT (Germany, the United Kingdom, Austria, and Belgium);

- Receiving money through: Receiving options are also in abundance with WorldRemit. The sender can always choose how the recipient can get their money. The options include bank account, mobile wallet, cash pickup, and home delivery and are limited to the recipient’s country;

- Payments flexibility: Customers can use WorldRemit’s website or mobile app to set up and pay for their international money transfers. All they need to do is sign up for an online account and provide the necessary details;

- Supported languages: WorldRemit’s website, mobile app, and help section are all available in English, French, German, Danish, Dutch, and Spanish;

- Regulated by: To comply with national and regional laws and regulations, WorldRemit has obtained authorization from every country/region they offer their services. The following are all the major regulatory bodies that authorize WorldRemit for operation:

- The Financial Conduct Authority (“FCA”) as an Electronic Money Institution (“EMI”) in the United Kingdom;

- The U.S. Department of the Treasury’s Financial Crimes Enforcement Network (“FinCEN”) in the United States;

- The National Bank of Belgium in the European Union;

- The Financial Transactions and Reports Analysis Centre of Canada (“FINTRAC) in Canada;

- The Australian Transaction Reports and Analysis Centre (“AUSTRAC”) in Australia;

- The Financial Service Providers Register (“FSPR”) in New Zealand;

- The Financial Supervision Authority (“FSA”) in Japan.

- Mobile app: WorldRemit offers a very convenient mobile app that is available for all smartphone users. Those with Android devices can download the app on Google Play (with a rating of 4.7 out of 5 stars) and those with iOS devices can find it on the App Store (with a rating of 4.8 out of 5 stars);

- Awards: While WorldRemit cannot be referred to as a veteran in the international money transfer space, the company is one of the biggest in the industry and, as such, received numerous awards and accolades over the past decade. Some of them include:

- Best Practice in Remittances for Development by IFAD (United Nations Agency, 2015);

- Technology Fast 50 (Deloitte, 2015, 2016, and 2017);

- Tech Track 100 (Sunday Times, 2016, 2017, 2018, and 2019);

- Excellence in Transformational Business (FT/IFC Transformational Business Awards, 2017);

- EY Entrepreneur Of The Year (2016);

- Bronze Award (European Contact Centre & Customer Service Awards, 2019);

- The Powerlist (BBC, 2020);

- Best for International Transfers (Best Money Transfer Apps – Investopedia, 2021 and 2023).

WorldRemit Features

As a provider optimized for handling remittances as a main transfer type, WorldRemit is super convenient with the number of options it offers its customers. Here are all the services this international money transfer company provides:

- Bank transfers: WorldRemit’s bank transfer services are unique in their ability to offer affordable and fast money transfers tailored to the needs of clients and their recipients from over 145 countries around the world. The provider maintains solid partnerships with hundreds of local banks and focuses on local currency transfers in order to make bank transfer options their standout feature;

- Cash pickup transfers: Another valuable WorldRemit feature is their cash pickup option, which allows clients to make money transfers that their recipient can collect in cash at a designated pickup location. This option is quite desirable and often sought after by people who don’t own a bank account, or for those who prefer the private aspect of receiving cash rather than a direct transfer to their bank account;

- Home delivery transfers: WorldRemit is one of the very few that offer an option to deliver the money sent by a customer to the recipient’s home address. Currently available only for recipients located in Vietnam, this option is very practical for recipients who cannot access a bank or a physical location to receive their transfer, or for those who prefer the privacy of having physical cash safely delivered to their home;

- Mobile money transfers: A feature that’s especially popular for customers in Africa, mobile money (electronic wallet) is a way to securely hold and manage funds on a device that supports an internet connection. WorldRemit offers this convenient option for customers to transfer mobile money as a way to lower fees and speed up the transfer process. Mobile money wallets offer the ability to make online or in-store purchases, pay bills and tuition fees, and withdraw cash at an authorized agent. They remove the need for owning a traditional bank account.

Additional WorldRemit Features

WorldRemit offers even more than the features we mentioned above. Let’s review these secondary features below:

- AirTime Top up: With WorldRemit, customers can send a mobile recharge to someone’s prepaid mobile phone call plan, known as an “airtime top up.” Essentially, WorldRemit makes a payment on behalf of the customer to add credit to the recipient’s mobile phone plan. This service is useful for people who need to recharge their phone while they are away from home or who may not have easy access to physical recharge vouchers or cards. With WorldRemit’s airtime top up service, customers can easily and securely provide mobile phone credit to their friends and family around the world.

- Mobile app: WorldRemit’s mobile app is a key feature of their service, offering customers a secure and user-friendly way to make international money transfers and track their transactions on the go.

One of the benefits of using the WorldRemit app is its accessibility and convenience. With only a few taps on their mobile phone or tablet, they can easily and quickly send money and track all of their transfers. The app also notifies customers of the status of their transactions in real time, giving them peace of mind that their money’s on the way to their recipients.

To top all that, the WorldRemit app complies with high security standards. It uses industry-grade encryption to protect customers’ personal and financial details, and adds measures to prevent fraudulent activity and ensure that funds are securely transferred. Everyone can download it for free from Google Play and the App Store, where it’s available for both Android and iOS devices.

WorldRemit International Money Transfer Costs

In general, the costs associated with making an international money transfer with WorldRemit are quite low compared to similar financial providers. To get a precise perspective of the exact rates and fees associated with WorldRemit, see the info below.

Exchange Rates

WorldRemit’s exchange rates are often better than those offered by other competing money transfer companies and certainly better than traditional banks. However, customers can expect a small portion of their transfer amount to go into these exchange rates as WorldRemit adds a profit margin on the mid-market exchange rates.

We’ve tested many different transfer samples and discovered that WorldRemit’s exchange rate markup starts at around 0.5% and goes up to about 2.5%. This markup depends on the transfer amount and the countries involved in it. On average, WorldRemit customers will face an exchange rate markup ranging between 1% to 1.6% added to their total currency exchange difference.

In any case, everyone interested in discovering their particular exchange rate can easily obtain an instant free quote or check the exchange rate they will receive before they make a transfer. WorldRemit is very transparent in this regard, ensuring that their customers are always informed and get a fair rate for their transactions.

Transfer Fees

WorldRemit does impose transfer fees on each transaction that they facilitate. These fees are always low and fixed and vary depending on the amount being sent, the origin and destination country, and the payment method selected. Typically, customers will notice that their transfer fee falls somewhere between $0.99 and $3.99, but no less or more than that.

Additional Fees

In addition to transfer fees, WorldRemit’s customers may also face extra fees for certain payment methods, such as credit or debit cards, or third-party bank fees.

Card fees are usually charged by the payment processing company and may vary depending on the card issuer and similar factors.

Some banks may also charge third-party fees to handle their part of the money transfer.

How Safe is WorldRemit?

WorldRemit is quite mindful of the safety and privacy of their customers’ data and money transactions, and puts in place a number of safety measures to guarantee that their service is reliable and secure.

One of WorldRemit’s primary security features is the use of cutting-edge encryption and data protection technology to protect their clients’ private and financial data. All client data is encrypted and stored using industry-grade protocols so it’s always protected from unlawful access or theft.

WorldRemit also utilizes a variety of safety precautions to protect from fraudsters and other threats. Their sophisticated systems for detecting fraud, identity verification methods, and money transfer monitoring tools are among the safeguards aimed at detecting and preventing abnormal or fraudulent activities.

Moreover, WorldRemit is authorized for operation by financial regulators in a number of countries, including:

- The Financial Conduct Authority (“FCA”) as an Electronic Money Institution (“EMI”) in the United Kingdom;

- The U.S. Department of the Treasury’s Financial Crimes Enforcement Network (“FinCEN”) in the United States;

- The National Bank of Belgium in the European Union;

- The Financial Transactions and Reports Analysis Centre of Canada (“FINTRAC) in Canada;

- The Australian Transaction Reports and Analysis Centre (“AUSTRAC”) in Australia;

- The Financial Service Providers Register (“FSPR”) in New Zealand;

- The Financial Supervision Authority (“FSA”) in Japan.

These institutions oblige WorldRemit to follow strict laws and compliance requirements to ensure that their clients’ services are safe and secure.

How Fast is WorldRemit?

WorldRemit provides quick and efficient money transfers, with up to 95% of all transactions processed in mere minutes. However, it’s important to note that the company’s transfer speeds might vary based on the payment method used, the destination country, and the transfer amount.

WorldRemit allows quick and safe money transfers by utilizing innovative technologies and frequently cooperates with local financial institutions and payment providers. They also provide real-time transfer tracking, allowing consumers to check the status of their money transfers and receive a notification when the transfer is complete.

Sending money through bank transfer or cash pickup might take 0-2 business days on average, however, transactions sent using mobile money or airtime top-up are usually processed within minutes.

It’s safe to say that WorldRemit’s transfer speeds are better than the industry average and faster than many traditional money transfer providers which might take multiple days or even weeks to process an international money transfer. Nevertheless, the post-pandemic era pushed for certain digital money transfer providers that may offer quicker transfer times when the transfer amount is smaller.

How to Use WorldRemit?

With a clear and user-friendly design, WorldRemit is a simple tool that makes it very easy to send money to friends and family across the globe. Let’s go through the step-by-step instructions for using WorldRemit:

- Register online: Sign up for a free online account via the WorldRemit website or mobile app. You’ll be required to provide some essential contact and personal data as well as legitimate identification proof;

- Select the payment method and destination country: Choose the country to which you wish to make a money transfer and your desired payment method (bank transfer, cash pickup, home delivery, mobile money, or airtime top-up);

- Provide the recipient’s details: Add your beneficiary’s name, contact information, address, and any other essential information, such as their bank account number or mobile money account information;

- Add the transfer amount: Provide the amount you want to send. You may be required to provide other necessary transfer details, such as the reason for the transfer if the transfer amount is higher;

- Review and confirm: Check all the transfer details and ensure that everything you entered is correct. Here, you’ll also be prompted to agree to the terms and conditions that apply to your money transfer.

- Pay for the transfer: WorldRemit provides a variety of selections so you can fund your money transfers. You can choose from a bank account, credit/debit/prepaid card, Apple Pay, POLi (Australia and New Zealand), Interac (Canada), iDEAL (the Netherlands), Trustly (Austria, Denmark, Estonia, Finland, Germany, Italy, Norway, Spain, and Sweden), and Klarna/SOFORT (Germany, the United Kingdom, Austria, and Belgium);

- Track the transfer: You can check the progress of your transfer in real time using the WorldRemit website or mobile app. You can also receive notifications on the mobile app when the transfer is complete.

WorldRemit Cancellation Policy

WorldRemit is one of the most relaxed money transfer providers in terms of cancellations and refunds of transfers. They allow customers to easily cancel their money transfers by accessing their online account on their website or mobile app and simply clicking the “request cancellation” button.

After the cancellation has been processed, the customer is notified by email and can await their refund to arrive within the following 7 business days.

However, it should be noted that this option won’t be available if the money transfer has already been paid out to the recipient.

Knowing that, customers should always be aware that cash pickup transfers and airtime top-ups cannot be canceled and refunded once they are paid out. There is a chance that bank transfers and mobile money transfers can be canceled even after they’ve been paid out if the recipient of the money consents to the cancellation. WorldRemit will contact them and ask for their authorization to refund the transfer.

It’s always a good idea to double-check every detail before going forward with a transfer to avoid the need for cancellation. It’s also recommended that customers cancel their transfers as soon as they make the decision to ensure the transfer hasn’t been paid out to the recipient.

WorldRemit Customer Service

WorldRemit enjoys a reputation as a provider that offers excellent customer service to its customers. Even though their support channels are limited, WorldRemit is always available to assist their clients with all their money transfer needs and issues.

There are two ways to resolve any potential money transfer issue with WorldRemit:

- Accessing the Help Hub: WorldRemit’s FAQ section is an extensive online help center with a wide range of topics, including everything from how to send money and fund a transfer to refund policies and guidance on how to use the mobile app. It is recommended that customers always go through this section before they move to the next available option, as the chances of finding a solution to their problem are quite high;

- Phone support: WorldRemit provides phone support in 24 countries where customers can send money from, as well as a phone number for the rest of the world. Here are some of the major counties’ phone support numbers:

- UK: +44 203 9666899

- USA: +1 855 383 7579

- Canada: +1 833 596 0890

- Germany: +49 800 112 2299

- France: +33 805 220535

- Spain: +34 900 431 571

- Japan: +81-50-6862-3679

- Australia: +61 1800 569135

- New Zealand: +64 800 995 011

- Rest of the world: +44 203 9666899

It should be noted that WorldRemit’s website, mobile app, and FAQ section are available in 6 languages, including English, Spanish, Ditch, Danish, French, and German.

Customers usually report their positive opinions of WorldRemit’s customer service. They stress their concerns with the lack of a wider variety of support options, but once they establish contact, they appreciate the knowledgeable and responsive customer support representatives. WorldRemit’s high customer ratings and positive reviews testify to their commitment to customer satisfaction.

How Does WorldRemit Compare With Its Competitors?

We compared WorldRemit to many of their top competitors and discovered that the provider stands out in several ways. For example, they offer more payment options than most of the competition, which usually limits the payment methods to a bank account and credit or debit card.

Additionally, WorldRemit offers fees and exchange rates which are often more affordable than similar money transfer services, their processing times are quite fast, and their cancellation policy is more relaxed and accommodating.

However, as is the case with any company, WorldRemit can be a bit behind some competitors in a couple of aspects. For instance, some providers don’t impose any transfer fees when initiating money transfers. Other companies are suitable for making both small and large money transfers, whereas WorldRemit is optimized for making only remittances and small money transfers. They don’t offer any business money transfer features as well.

Despite these drawbacks, WorldRemit can still be an amazing choice for all those who are looking for a reliable and affordable way to send money to family and friends internationally.

Below, we’ve compared WorldRemit with Remitly, Currencies Direct, and XE, so you can get a better idea of how WorldRemit stacks up against their top competitors.

WorldRemit vs. Remitly

| Feature | WorldRemit | Remitly |

|---|---|---|

| Founded in | 2010 | 2011 |

| Trading Volume | ~$10 billion | $20.4 billion in 2021 |

| Trustpilot Rating | 3.9 /5 | 4.1 / 5 |

| Suitable for | Remittances and small money transfers | Remittances (small monthly money transfers to family or friends) |

| Transfer Fee | $0.99 – $3.99 depending on the transfer amount and the selected countries and payment methods | $0.00 – $50 depends on the selected countries, the transfer amount, and the payment method ($3.00 – $7.00 on average) |

| Average Exchange Rate Markup | 0.5% – 2.5% added to the mid-market exchange rate (1% – 1.6% on average) | 1% – 2.5% on mid-market rates on average (can range between 0.5% and 3.7%) |

| Minimum Transfer Amount | $1 (or currency equivalent) | $1 (or currency equivalent) |

| Maximum Transfer Amount | Depends on the selected countries and method of payment (ranges between $1,400 and $60,000) | Depends on the sending and receiving country, the transfer amount, and the transfer method (from $3,000 to £150,000) |

| Transfer Speed | 0-2 business days on average (within minutes in 95% of cases) | Within minutes (Express delivery); 3-5 business days (Economy delivery) |

| Dedicated Dealer | No | No |

| Countries Covered | Sending from over 50 countries; Receiving to over 145 countries | Over 180 countries |

| Currencies Covered | Over 70 currencies | Over 75 currencies |

| Payment Methods | Bank account, credit/debit/prepaid card, Apple Pay, POLi, Interac, iDEAL, Trustly, and Klarna/SOFORT | Bank account, credit or debit card, Passbook (USA), Klarna (Germany and Austria), SEPA (France), and iDEAL (the Netherlands) |

| Receiving Methods | Bank account, mobile wallet, cash pickup, and home delivery | Bank account, cash pickup, mobile wallet, and home delivery |

| Cash Pickup Option | Yes | Yes (about 400,000 locations worldwide) |

| Instant Custom Quote | Yes | No |

| Business Features | No | No |

| Flagship Debit Card | No | Yes (Passbook card) |

| Mobile App | Yes | Yes |

| Cancellation Policy | Only when the transfer hasn’t been paid out. Bank and mobile wallet transfers may be refunded even after the transfer is completed if the recipient agrees to the refund. | Only available for transfers that are still “in the hands” of Remitly. Once they are intercepted by a bank, transfers cannot be canceled. |

Read our full Remitly review.

WorldRemit vs. Currencies Direct

| Feature | WorldRemit | Currencies Direct |

|---|---|---|

| Founded in | 2010 | 1996 |

| Trading Volume | ~$10 billion | £9.5 billion in 2021 |

| Trustpilot Rating | 3.9 /5 | 4.9 / 5 |

| Suitable for | Remittances and small money transfers | Large money transfers |

| Transfer Fee | $0.99 – $3.99 depending on the transfer amount and the selected countries and payment methods | No fee |

| Average Exchange Rate Markup | 0.5% – 2.5% added to the mid-market exchange rate (1% – 1.6% on average) | 0.4% to 1.4% on mid-market rates |

| Minimum Transfer Amount | $1 (or currency equivalent) | £1 (or currency equivalent) |

| Maximum Transfer Amount | Depends on the selected countries and method of payment (ranges between $1,000 and $9,000) | £25,000 through the mobile app; £300,000 by placing a special request |

| Transfer Speed | 0-2 business days on average (within minutes in 95% of cases) | 12-24 hours within Europe; 24-48 hours for overseas transfers |

| Dedicated Dealer | No | Yes |

| Countries Covered | Sending from over 50 countries; Receiving to over 145 countries | Over 200 countries |

| Currencies Covered | Over 70 currencies | Over 70 currencies |

| Payment Methods | Bank account, credit/debit/prepaid card, Apple Pay, POLi, Interac, iDEAL, Trustly, and Klarna/SOFORT | Bank account, credit/debit card, or check |

| Receiving Methods | Bank account, mobile wallet, cash pickup, and home delivery | Bank account |

| Cash Pickup Option | Yes | No |

| Instant Custom Quote | Yes | No. Quotes are available through email for registered users |

| Business Features | No | Spot contracts, forwards contracts, limit orders, stop-loss orders, recurring transfers, digital multi-currency wallet, rate alerts, and API portal |

| Flagship Debit Card | No | No. A card for international travelers is available through a third-party service (WeSwap) |

| Mobile App | Yes | Yes |

| Cancellation Policy | Only when the transfer hasn’t been paid out. Bank and mobile wallet transfers may be refunded even after the transfer is completed if the recipient agrees to the refund. | No |

Read our full Currencies Direct review.

WorldRemit vs. XE

| Feature | WorldRemit | XE |

|---|---|---|

| Founded in | 2010 | 1993 |

| Trading Volume | ~$10 billion | $115 billion in 2018 |

| Trustpilot Rating | 3.9 /5 | 4.2 / 5 |

| Suitable for | Remittances and small money transfers | Both small and large money transfers |

| Transfer Fee | $0.99 – $3.99 depending on the transfer amount and the selected countries and payment methods | £2.00 under £250 (UK); €2.00 under €250 (EU); No fee for other sums |

| Average Exchange Rate Markup | 0.5% – 2.5% added to the mid-market exchange rate (1% – 1.6% on average) | 0.2% to 1.4% on mid-market rates |

| Minimum Transfer Amount | $1 (or currency equivalent) | £1 |

| Maximum Transfer Amount | Depends on the selected countries and method of payment (ranges between $1,000 and $9,000) | £350,000 (UK and EU); $535,000 (US); CAD $535,000 (Canada); NZD $750,000 (New Zealand) |

| Transfer Speed | 0-2 business days on average (within minutes in 95% of cases) | 1-4 working days |

| Dedicated Dealer | No | Only for those transferring above $70,000 |

| Countries Covered | Sending from over 50 countries; Receiving to over 145 countries | Over 130 countries |

| Currencies Covered | Over 70 currencies | Nearly 100 currencies |

| Payment Methods | Bank account, credit/debit/prepaid card, Apple Pay, POLi, Interac, iDEAL, Trustly, and Klarna/SOFORT | Bank account or credit/debit card |

| Receiving Methods | Bank account, mobile wallet, cash pickup, and home delivery | Bank account and cash |

| Cash Pickup Option | Yes | Yes |

| Instant Custom Quote | Yes | Yes |

| Business Features | No | Spot contracts, forwards contracts, market orders, digital multi-currency wallet, rate alerts, and API portal |

| Flagship Debit Card | No | No |

| Mobile App | Yes | Yes |

| Cancellation Policy | Only when the transfer hasn’t been paid out. Bank and mobile wallet transfers may be refunded even after the transfer is completed if the recipient agrees to the refund. | Only for cash pickup transfers when the cash hasn’t been collected by the recipient |

Read our full XE review.

WorldRemit Customer Reviews

Online customer reviews are undeniably a valuable resource for anyone looking to evaluate an international money transfer service before they make up their mind on a single one. When it comes to WorldRemit, the company’s feedback from its customers has been mostly positive, with many praising the company’s affordability, transparency, ease of use, excellent customer support, and more.

Trustpilot reviewers appreciate WorldRemit’s user-friendly mobile app and website, which make it easy to initiate and track transfers. They also frequently mention the company’s low fees and competitive exchange rates, which help them save money when sending funds across borders. There’s also much love for the plethora of payment options the company provides.

Another aspect that frequently receives praise in online customer reviews is WorldRemit’s customer service. Many of them testify that the provider’s support team is responsive, knowledgeable, and willing to go the extra mile to resolve any troubling issues. The only negative complaint in this regard are the slow waiting times when a user needs to get in touch with a representative.

Of course, no company is perfect, as WorldRemit has also received some negative feedback from customers who experienced issues with refunds and transfer delays. However, these negative sentiments are only a few compared to the positive ones, as the majority of customers seem to be satisfied with how WorldRemit conducts business.

Below, you can read a selection of the most common aspects customers mention when discussing their experiences with WorldRemit.

Positive WorldRemit Customer Reviews

I’ve been using their services for years, they’re quick but my last transaction was debited out of my bank account, and the app prompted an error. I didn’t get any transfer number or email, I don’t have a case number either, and I can’t contact them over the phone since I don’t have a case or transaction number. I would like to get my money back.

One hour later after reviewing WorldRemit, a very nice customer agent called me back and was able to solve this inconvenience. Now it’s a matter of time to get my money back, I will update once I get the money back.

– Miguel Salamanca

I tried sending money to the Philippines with the other money senders and all I got was a massive headache. I currently work overseas and was at wits end, even when I called the customer support lines it was just a plain roadblock. With WorldRemit I simply signed up, filled in my information and the receivers information, and BAM, the money was sent in a matter of minutes. WorldRemit now has a customer for life. Very fast and easy. Thank you WorldRemit. I am a happy customer.

– Rescuedude

WorldRemit deserves more than 5 stars. I have been using WorldRemit if I am not mistaken, since 2013. And only very few times have I ever had a problem with my remittances, but I never panicked because WorldRemit always had a quick solution or refunds very quickly. I also found out that it is the partner of our choice that always caused troubles. If I can give WorldRemit more than 5 stars I will be more than willing. Because they deserved it!

– Joson

Best exchange rates & intuitive use for both sender and receiver of the money. What I love about the WorldRemit app is that my mum who is not technical at all can receive the updates to my monthly transfers. I find their service easy to use and the rates are the best that I have seen. My family members also have ways to receive money and all the transactions are hassle free.

– Torch

Negative WorldRemit Customer Reviews

I had a very bad experience with WorldRemit. I sent money to a family member in Ghana, the number she gave me was wrong so the money went to someone else’s account. I contacted Ghana memo which is the agency in Ghana to get your money from. The agents in Ghana were able to retrieve the money from the person who mistakenly was given the money. Ghana people gave me evidence and confirmation numbers to show they did their part. I called WorldRemit and still do not have my money back to me or the person who was supposed to receive it. I think they are using my money for business.

– Cecilia Ccl

Terrible customer service and don’t stand by their promotional offers. The money did go from my account to another country in a decent time frame, I’ll give them that. But they don’t stand by their promotional offers, customer service is rude, and they just don’t reply to emails. In my experience, they just disregard the customer as unimportant and are only interested in your money. I would use other options in the market. I don’t recommend them.

– Matheus Capovilla

No reward as advertised for referral. When it works well it’s great to send funds through WorldRemit. I’ve used them many times. However, do not fall for their advertising ploy of offering you a £25 reward if you refer a friend. They simply don’t and make all sorts of excuses as to why, even after you give them evidence of the code used etc. Their customer service is difficult to contact and all they have is a standard response. It is disappointing and it feels like taking advantage of the customers – no way to grow a brand. Soon enough another money transfer company will come on the market that will be as good but without the marketing trickery.

– VeronicaCM

Usually whenever I send money it goes faster. But this time my money is held for a longer time. I provided the necessary documents. I don’t know when the money will be released. I can’t find the live chat agent. How to solve the problem?

– Ishrat Sultana

WorldRemit Alternatives

Since no company is perfect for every type of customer, we don’t expect everyone to jump aboard and immediately start using WorldRemit. That’s why we’re providing a few solid alternatives that might be more suitable for those who can’t find a solution by turning to WorldRemit.

Currencies Direct

Currencies Direct is a reputable international money transfer company that’s quite similar to WorldRemit with some key differences.

Currencies Direct supports a wider range of currency exchange options than WorldRemit, including more exotic currencies. Among their business features, there are specialized services such as forward contracts and money orders which allow customers to lock in exchange rates for future transfers.

Additionally, while WorldRemit is primarily focused on individuals who need to make smaller, more frequent money transfers, Currencies Direct is geared towards businesses and individuals who need to transfer larger sums of money. This makes Currencies Direct a better alternative for those who are looking to send larger money transfers, such as paying international teams, purchasing property, or investing overseas.

Having no transfer fees can be a deal-maker for some customers as well.

Revolut

Revolut is more of a digital banking service rather than a money transfer company even though they offer that kind of service as well.

Some customers would choose Revolut instead of WorldRemit because of their extraordinary prepaid debit card, budgeting tools, and the fee-free currency exchange service. These features are regularly sought after by customers who want an all-in-one solution for their financial necessities.

Revolut can also be faster than WorldRemit, with most of their transfers being completed instantly or within a few minutes.

However, it’s worth noting that Revolut might impose higher exchange rates than those that WorldRemit has, and their maximum transfer limits are sometimes lower.

MoneyGram

MoneyGram is, obviously, a more popular choice than WorldRemit because of their wide-spread coverage and bigger marketing campaigns. This money transfer provider has been around for decades and, besides its extensive experience in the industry, it has one big advantage over WorldRemit.

MoneyGram offers in-person transfers which allow the sender to visit an agent location and drop off cash as a funding method for their money transfer. This kind of service comes with a higher price, of course, as WorldRemit’s fees and rates are considered more competitive than those imposed by MoneyGram. WorldRemit has more online payment options as well, so customers prone to dealing with everything by going online can benefit from this feature.

Conclusion

Time to wrap things up!

In this review, we’ve discussed WorldRemit – a leading international money transfer service that provides reliable, fast, and convenient ways to send money overseas. We’ve talked about their background, features, rates and fees, safety, speed, customer service, and customer reviews. We also compared them with some of their fiercest competitors, namely Remitly, Currencies Direct, and XE.

From our expert evaluation, we can confidently state that WorldRemit stands out because of their wide range of payment options, competitive rates, fast processing times, and excellent refund policy. Their strong focus on safety and reliability allows them to protect their customers’ private and financial information with great confidence.

If your money transfer needs involve making small and frequent money transfers to your family and friends abroad, rest assured that WorldRemit can greatly assist you on that quest.

F.A.Q.

Can I use WorldRemit to pay for regular purchases (such as for my coffee at Starbucks)?

No, WorldRemit cannot be used for making payments for goods and services in physical stores. Its purpose is to facilitate international money transfers.

What should I do if my recipient hasn’t received the money?

In a case like this, it’s best to reach out to WorldRemit’s customer service and provide them with all the details of the transfer.

Ensure you have all of your recipient contact details as well as they might need to contact their bank or other financial institution that’s in charge of their account.

Kerstin Bitsch says

What can I do if I have a payee number

I forgot to write down

And the money is sent??? (translated from German)

Mary says

My money got lost in the air. I see the transaction is being processed since June but neither Worldremit or the receiving bank seem to know where the money is.

Alicia says

Today is the third day since I tried to send money through worldremit and you canceled the transaction without giving me any valid explanation AND YOU HAVE NOT RETURNED MY MONEY, THIRD DAY THAT YOU HAVE WORKED WITH MY MONEY AND YOU DON’T WANT IT RETURN!!!

I need my money back, there are people urgently waiting for that money, why are you so unfair? Why are you guys so abusive? Why do you kidnap the money of people who trust you to make shipments? This already seems like a scam!

GIVE ME MY MONEY BACK! OR ARE YOU GOING TO STAY WITH IT? You answered me that my bank has it but that is not true, my bank has already opened an investigation into the reason why you do not return the money and you continue saying that the bank has the money when that is not true!

I am still very attentive to your comments about WHEN YOU WILL GIVE ME MY MONEY BACK.

Alicia says

I’ve been waiting for my money back for 5 days and all you do is give evasive answers, I’ve seen multiple reviews from people who have had the same thing done to them!!! Lying scammers

Pavel Pataki says

Why you banned me from using a Czech WordRemit account

I have become a customer ,and you have banned me from using Wordsremit my account

No one deals with the complaint

I’m sad that wordsremit forbids supporting poor children in Africa whom I help, wordsremit banned my account!