If you’re planning to send money internationally, you might have a hard time choosing from the variety of money transfer services out there. From traditional banks to specialized international money transfer companies, there are dozens of ways to send money across borders. And with so many options available, the difficulty of knowing which one is the best for you always arises.

While banks are traditionally considered the first choice for sending money abroad, international money transfer providers can offer faster and cheaper services with the same reliability and security as big banks.

Whether you’re sending a small amount of money to a friend or family member, making a large payment for a business transaction, or simply looking to exchange currency, we’re here to help. Below, we’ll provide you with the information you need to make an informed decision and get the most value for your time and money.

To help you navigate through the sea of such services, we’ve compiled a list of the 11 best international money transfer services. In this article, we’ll review these popular and highly-rated services and discuss the pros and cons of each one. We’ll also provide additional tips on what to consider when selecting a money transfer provider and how to compare different options to find the best one for you.

So, read on to learn more about the top international money transfer services and how you can leverage your knowledge to make the most out of your chosen option.

Let’s begin with a comparison chart that features all of the 20 international money transfer providers included in this article.

Currencies Direct are the top rated International Money Transfer Service on our list.

- 4.9 out of 5 on Trustpilot based on over 8,000 reviews

- No transfer fees

- Bank-beating rates

- Award-winning service

- Exclusive Amazon gift card offer for users of MoverDB.com

| No. | Provider Name | Trustpilot Rating | Minimum Transfer Amount | Maximum Transfer Amount | Transfer Fee |

| 1 | Currencies Direct | 4.9 | £100 | £300,000 | No fee |

| 2 | XE | 4.2 | £1 | £350,000 (UK and EU) $535,000 (US) CAD $535,000 (Canada) NZD $750,000 (New Zealand) | £2.00 under £250 (UK) €2.00 under €250 (EU) No fee for rest |

| 3 | Wise | 4.5 | £1 | £5,000,000 (UK) $6,000,000 (USA) €6,000,000 (Europe) AUD $1,800,000 (Australia) CAD $1,500,000 (Canada) | 0.4% – 0.6% of total amount (on average) variable fee + £0.2 – £0.3 (on average) fixed fee |

| 4 | CurrencyFair | 4.4 | €8.00 (or currency equivalent) | 10,000,000 (same in every available currency) | €3.00 (or currency equivalent) |

| 5 | OFX | 4.1 | $1000 (US) £100 (UK) €2 (EU) $150 (Hong Kong and Singapore) $250 AUD and its currency equivalent in the rest of the world | None | AUD $15.00 under $10,000 (Australia) CAD $15.00 under $10,000 (Canada) HK $60.00 under $10,000 (Hong Kong) NZD $15.00 under $10,000 (New Zealand) No fee for rest |

| 6 | Remitly | 4.1 | $1 (or currency equivalent) | Depends on the sending and receiving country, the transfer amount, and the transfer method (from $3,000 to £150,000) | $0.00 – $50 depends on the selected countries, the transfer amount, and the payment method ($3.00 – $7.00 on average) |

| 7 | WorldRemit | 4.0 | $1 (or currency equivalent) | Depends on the the sending and receiving country and the selected payment method | $1.00 – $4.00 depends on the selected countries and payment methods |

| 8 | Send Payments | 4.8 | $250 (or currency equivalent) | None | No fee |

| 9 | TorFX | 4.9 | £100 (or currency equivalent) | None | No fee |

| 10 | MoneyGram | 4.3 | $1 | Depends on the sending and receiving country (usually $10,000 or currency equivalent) | Depends on your location, the amount you’re sending, and your payment method. Some transfers come with a transfer fee that’s as low as $0-$15 and others, such as paying with a credit card to an exotic location, can generate up to $100 in transfer fee |

| 11 | Western Union | 3.9 | $1 | Anywhere between $2,000 to $50,000 (or currency equivalent) depends on the sending and receiving country and the selected payment method | Depends on your location, the amount you’re sending, and your payment method. Some transfers come with a transfer fee that’s as low as $0-$15 and others, such as paying with a credit card to an exotic location, can generate up to $100 in transfer fee |

| 12 | Instarem | 4.4 | $50 for India None for rest | Depends on the origin country and the selected payment method | Depends on the selected countries, the transfer amount, and the selected payment method |

| 13 | Key Currency | 4.9 | $1 | None | No fee |

| 14 | VertoFX | 4.1 | $1 | None | No fee |

| 15 | Moneycorp | 4.3 | £50 (or currency equivalent) | £100,000 (or currency equivalent) for online transfers None for phone transfers | £0.00 online transfers £15.00 phone transfers |

| 16 | Caxton | 4.6 | £100 (or currency equivalent) | £100,000 (or currency equivalent) | No fee |

| 17 | CurrencyTransfer | 4.9 | £5,000 (or currency equivalent) | None | No fee |

| 18 | Global Reach | 4.8 | £1,000 (or currency equivalent) | None | £20.00 under £3,000 £0.00 above £3,000 |

| 19 | Currency Solutions | 4.8 | £100 (or currency equivalent) | No limit for transfers over phone Online transfers: £20,000 for personal accounts £50,000 for business accounts | £10.00 under £3,000 £0.00 above £3,000 |

| 20 | Revolut | 4.3 | $1 (or currency equivalent) | Depends on the selected plan, the sending country, and the recipient country | No fee for transferring to other Revolut users; Card transfers: 0.7% (if you’re in Europe) 2.3% (outside Europe) Bank transfers: fees can range between 0.35% and 1% |

Best International Money Transfer Services

1. Currencies Direct

Pros:

- High popularity

- No transfer fee

- High Trustpilot ranking

- Competitive exchange rates

- Wide range of currencies

- Great customer service

- Convenient payment options

- Flexible transfer options

- One of the most available services internationally

Cons:

- No cash pickup option

- High exchange rates for lower transfers

- Web platform and mobile app are less intuitive than some of the competition

- Not optimal for sending money to family in South America or Asia

Currencies Direct is a top-rated company with a flawless reputation on TrustPilot. With over 25 years of experience and over 250,000 satisfied customers, they have established themselves as a trusted and reliable choice for international money transfer services.

One of the standout features of Currencies Direct is their competitive exchange rates and lack of transfer fees, making them a great choice for anyone looking for the best price on their cross-border transactions. Setting up an account is a breeze, and it’s completely free whether you choose to do it on their web platform or through a mobile device.

While Currencies Direct is an excellent choice for most people, it’s worth noting that they only work with a little over 40 different currencies. This may be a limitation for those looking to send money to less common destinations, but those dealing with major currencies will experience no setbacks.

However, the company’s top-notch customer service and consumer-focused approach has earned them numerous accolades, including the Consumer Champion of the Year award in 2017 and the Money Transfer Provider of the Year award in 2018.

Even though Currencies Direct is more suitable for making larger international transfers and doesn’t provide a cash pickup option, their pros vastly outweigh the cons. That’s why they are our top recommendation for online money transfer services in the USA and worldwide.

Read our full Currencies Direct review.

2. XE

Pros:

- Terrific customer reviews

- Amazing online platform with tons of tools and resources

- Low transfer fees

- Competitive exchange fees

- Available in over 170 countries worldwide

- Wide range of currencies

- Suitable for small money transfers

- Multilingual support

Cons:

- Transfer fee for small money transfers

- Many complaints about customer service

- Transfer times are a bit slower than the competition

XE is a well-known name in the world of international money transfers, with a great star rating on Trustpilot. It offers a variety of features that set it apart from other companies in the market, including seamless currency conversion and same-day money transfers to over 170 countries on all 6 continents.

This provider is highly appreciated because of its excellent exchange rates and lack of additional fees for sending money. They are primarily an online company that enables users to handle international and domestic money transfers from anywhere through their web or mobile platforms. Each user is given the opportunity to open a private account on the company’s website that can be accessed and used 24/7.

They boast almost 300 million visitors to their site annually and their app has been downloaded over 70 million times. With such a strong customer base, XE cooperates with over 200 leading global brands, including Apple, Google, Walmart, and Amazon, and in 2015 alone, it facilitated the safe and efficient transfer of over $74 billion dollars.

XE values the security of its customers and protects them with the help of Norton Security. They are also authorized by the FCA. Their users can set up free accounts for personal or business use in no time. Their online features include 24-hour tracking of customers’ money transfers, giving users peace of mind and transparency in their transactions.

Read our full XE review.

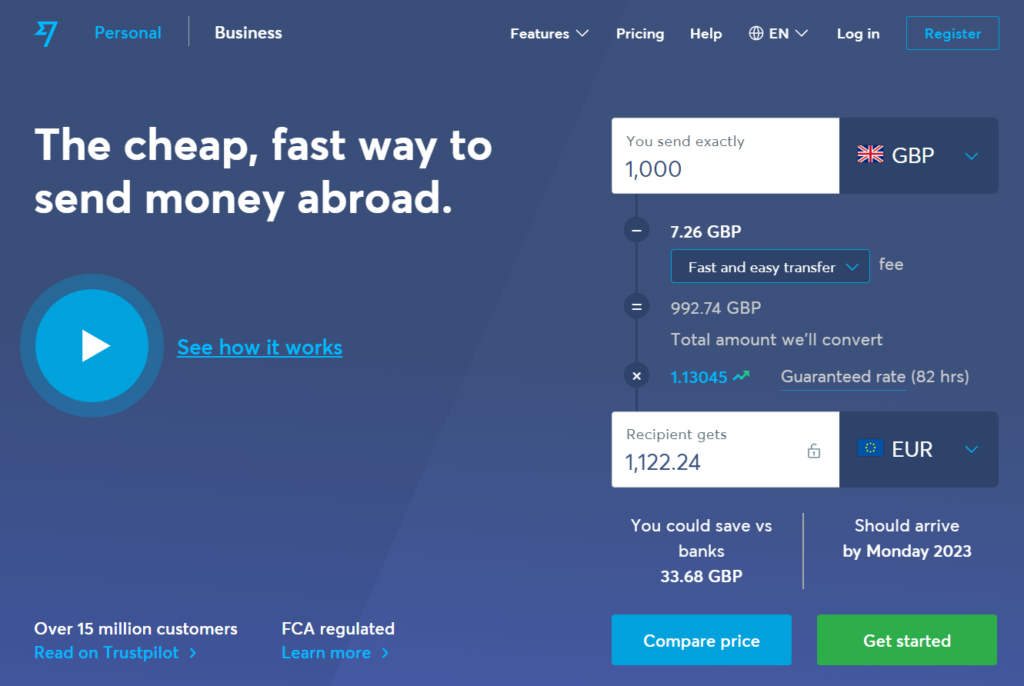

3. Wise

Pros:

- Excellent worldwide coverage

- No markup on exchange rates

- Transparent rates and fees

- Great mobile app

- Big on user’s interface and convenience

- Flagship multi-currency card

- Fast money transfers

Cons:

- Not too suitable for large money transfers

- There’s a fee for holding money in the Wise account

- No cash pick-up option

- Prices have significantly increased since 2020

Formerly known as TransferWise, Wise is a highly rated and trusted company for international money transfers, with a Trustpilot score of 4.5 out of 5. They have a large customer base, with around 16 million users sending a total of approximately £76.4 through their platform each year in over 70 countries.

The company has physical offices in 17 locations around the world. Wise charges a fee for their service, but it is usually low, with some transfer fees as low as $1 plus a 1% commission on the total transfer amount. These low fees make it a good option for smaller transfers, although for amounts over $10,000, other companies may be more cost-effective.

Wise is transparent about all their fees and imposes no hidden charges. They offer a range of options for sending money, including bank wire transfers of up to several million dollars (or currency equivalent), debit and credit card payments, direct bank transfers, and Apple Pay.

While next-day transfers are possible with Wise, they may not work for all transactions and the recipient may not have immediate access to the transferred funds, depending on their bank’s availability.

A key advantage of Wise is that they use the official exchange rate set by the government and adjust their own rate accordingly, ensuring that customers do not pay an inflated rate for their transfers.

Read our full Wise review.

4. CurrencyFair

Pros:

- Highly rated in online reviews

- Offers special promotions

- Integration with other financial tools

- Transparent rates and fees

- Low markup on exchange rates

- Provides the ability to hold foreign currency in their online account

- Great mobile app

Cons:

- Payment methods such as cash or credit card are not available

- Only deals with about 20 major currencies

- Not too suitable for large money transfers

- Doesn’t provide customers with dedicated dealers

CurrencyFair is a well-respected global company that has been in operation for almost a decade. Annually, they facilitate the exchange of over 8 billion euros, equivalent to around 9 billion US dollars.

With a 4.4 out of 5 stars on Trustpilot, CurrencyFair is one of the best-rated international money transfer providers. The company is headquartered in Ireland and the UK, but also has offices in Hong Kong, Australia, and Singapore.

Users can set up an online account in a simple manner for free, after which they can send and receive money to and from over 150 countries. While they are often used as a platform for receiving money rather than transferring it, both options are available. Receiving bank transfers directly into a CurrencyFair account is free, but other types of transfers usually incur fees. Their website also warns that there may be additional bank fees depending on any third-party institutions involved in the process.

CurrencyFair offers two innovative features: a chatbot and the ability to set up automatic transfers. The chatbot is an online help tool available 24/7 on the website, allowing users to get assistance in real time. The automated transfer feature allows customers to schedule transfers up to two weeks in advance, which can be adjusted or canceled at any time during this time period. Detailed instructions on how to set up this feature can be found on the CurrencyFair website, and the chatbot is also always available.

Read our full CurrencyFair review.

5. OFX

Pros:

- No cap on the maximum transfer limit

- No transfer fees for US, UK, and European residents

- Support for more than 50 currencies

- Large network of supported banks

- Great online rating

- Easy-to-use mobile app

- Non-stop customer support

- Additional features such as forward contracts, recurring payments, limit payments, etc.

Cons:

- Payments are available only through bank accounts

- No cash pick-up option

- Slower transfer times than the competition

- Customer support is on the slow side

OFX is one of the highest-rated companies for international money transfers that cater to both personal and business users who wish to make transfers of any volume. They do not charge any fees for transferring money for their clients in the USA and Europe through their platform. However, sending money with OFX can only be accomplished through a bank account, meaning only wire transfers are supported.

OFX is a global venture with offices in major hubs across the world, such as the UK, the US, Australia, Europe, Canada, Hong Kong, and New Zealand. That adds extra layers of security for customers with different national backgrounds. Even though sending money with OFX is done online or through the phone, they don’t support an online wallet option. That means that recipients need to provide their bank account information and receive the money right in their bank account.

Besides support for all major world currencies (the full list can be found on their website), OFX allows customers to put a “lock” on their targeted exchange rates so they can guarantee they can get that rate when they decide to make a transfer. Users can use their online platform or mobile app to track their transfers in real time.

Regarding transfer times, OFX is a bit slower than similar companies. They do not offer same-day transfers, and recipients can expect to get their money on the second day, with the waiting time sometimes extending to up to five days.

Read our full OFX review.

6. Remitly

Pros:

- Transparent rates and fees

- Great mobile app

- Fast money transfers

- Rewarding referral program

- Operates in over 100 countries worldwide

- Offers a money-back guarantee

- Has a door-to-door delivery option

Cons:

- Not suitable for large money transfers

- Exchange rates vary from country to country

- Low cap on the maximum limit

- Doesn’t offer recurring money transfers

Focused on fast international money transfers, Remitly is a company that mainly deals with remittances – sending money to friends and family abroad. Based in Seattle, WA, Remitly was founded a little over a decade ago but managed to become one of the most frequently used remittance providers in the US.

Operating with a cast network of over 30,000 banks throughout the entire world, Remitly has their own physical locations in almost 60 countries. That makes it very convenient for everyone who uses them to send and pick up money in a safe, reliable way.

Naturally, Remitly doesn’t offer hedging options and dedicated dealers since it isn’t suited for large transfers. Their clientele is comprised of personal users who send smaller amounts of money across borders. Users have the opportunity to choose from over 70 currencies and transfers can be done in just a few minutes.

The great thing about Remitly is that the more you use them, the more benefits you get. They have an amazing referral program and if you provide more government-issued documents, you can enable a higher cap on your maximum sending limit.

Remitly’s transfer fees vary largely and depend on the amount of money that you’re sending, the speed of the transfer, the payment method you’ll use, and the location you’re sending the money to.

Read our full Remitly review.

7. WorldRemit

Pros:

- Worldwide network of over 130 countries

- Cash pick-up option

- Airtime top-up option

- Excellent mobile app

- Great for customers in Africa

- Quick transfers

Cons:

- High margins on exchange rates

- Low cap on maximum transfer limit

- Not suitable for large money transfers

- Some hidden fees

WorldRemit is a remittance company that has over 67,000 votes on Trustpilot, most of which are 4 and 5 stars. Its network of coverage includes not only the countries with the most prominent currencies but also developing countries that are less connected by other similar providers.

WorldRemit is one of the oldest names in the international money transfer space and today its value is estimated to approx. $6 billion. The company’s vision is always focused on growth, so it won’t be a surprise if they further increase their value and reputation in the near future.

When it comes to the satisfaction of their customers, WorldRemit has seen many online complaints about their customer service and the speed at which it resolves customers’ issues. However, they compensate by offering cheap prices, straightforward online tools, and great coverage.

For some regions like Asia and Africa, WorldRemit has revolutionized the remittance market by providing immigrant workers with accessible and affordable money transfer services.

While this provider imposes considerable margins on their currency exchange rates, they are still considerably cheaper than traditional banks. It all depends on the country you wish to send money to and its currency. So, if it turns out that your particular case yields a high exchange rate, you can always try any of the WorldRemit’s alternatives in this article.

Another aspect where WorldRemit scores high points are their frequent special promotions and online coupons which customers can use to lower the fees on their overall transfer amount.

Read our full WorldRemit review.

8. Send Payments

Pros:

- No transfer fees

- No cap on the maximum transfer limit

- Fast transfer times

- Extensive worldwide coverage

- Dedicated transfer dealers

- Fantastic design and branding

- Excellent online ratings

- Additional features for hedging

- Great exchange rates

Cons:

- Only available for Australian customers

- No mobile app yet

- Payments are available only through bank accounts

- Limited number of currencies are supported

Founded in 2019 by two TorFX ex-employees, Send Payments is an Australian international money transfer provider. Despite being such a young fintech business, Send Payments is one of the top companies in the international payment industry, boasting thousands of clients across all continents.

The company allows only Australian citizens to send money anywhere in the world and boasts one of the best web designs among companies of the like. Other than that, Send Payments provides great value for their customers as they charge no transfer fees and impose no maximum limit on any transfer amount.

One of the best Send Payment assets is their dedication to each customer. They provide a personal account manager that takes care of every customer’s profile and guides them wherever they need to initiate a money transfer.

Additionally, Send Payments provides a digital wallet and a cashback feature for all personal users that enables them to earn a bonus on each of their transfers. Business users can take advantage of hedging options such as forward contracts and earn discounts on all bulk money transfers they make.

Send Payments is suitable for making both small and large international money transfers, although, it should be noted that they impose a minimum transfer limit of $250 (or currency equivalent).

Read our full Send Payments review.

9. TorFX

Pros:

- No transfer fees

- No cap on the maximum transfer limit

- Fast transfer times

- Great mobile app

- Excellent online ratings

- Fantastic customer service

- Specialized in money transfers regarding immigration and property

- Additional features such as spot contracts, market orders, and forward contracts

Cons:

- Requires lots of documents to sign up

- Payments are available only through bank accounts

- Not too suitable for small money transfers

Based in the United Kingdom, TorFX is a continuously-growing money transfer company that has been in business for almost two decades. To date, they facilitated transfers of over $1.2 billion dollars (€1.13 million euros).

TorFX is an expert in the field, having earned many industry recognitions throughout their existence, among which is the Best Euro Money Broker award in 2020 and 2021. They’ve also been awarded the Best Money Transfer Provider award for four years in a row (from 2016 to 2019).

This industry veteran is one of the most trusted international money providers with no recent debt and a credit rating of perfect standing (Level 1).

A TorFX side that customers truly appreciate is their customer service. The company employs highly-skilled account managers that promptly respond to all user requests. Their rates are also clearly stated during the transfer process with the exception of third-party fees that banks can collect for their side of the transfer.

With TorFX, customers can transfer money in about 60 international currencies in one-time or recurring payments. For business users, TorFX has excellent specialized options like business health checks, stop loss orders, limit orders, etc. for achieving optimal exchange rates.

Read our full TorFX review.

10. MoneyGram

Pros:

- Most popular money transfer provider alongside Western Union

- In the industry for over 80 years

- Available almost everywhere

- Cash pick-up option available in thousands of locations

- Bank accounts are not necessary

- Suitable option for remittance transfers

- High money transfer speed

- Offers rewards for regular customers

Cons:

- Doesn’t have the best online rankings

- Not suitable for large money transfers

- Higher exchange rates compared to the competition

- Imposes transfer fees

- Low maximum transfer limits

MoneyGram is one of the most popular money transfer companies around the world. It was founded in the 1940s in the United States and has since served millions of customers. Today, you can find them in over 200 countries with more than 350,000 agents available in banks and other physical locations.

This company’s business model revolves mostly around serving personal users who wish to send money to friends and family abroad. They have made their transfer process extremely simple, fast, and secure, and therefore, they are usually more expensive than smaller providers.

MoneyGram imposes transfer fees which they base on the amount you’re sending. Additionally, their exchange rates are a bit higher than less-known competitors and vary depending on the country you send from and the currency you wish to transfer to.

Their payment methods include cash, debit/credit card, and bank accounts, with cash accumulating the highest fees while transfer from and to a bank account is the cheapest of their options.

MoneyGram can also deliver cash in some countries and locations, and with it, you can also send money to an inmate. In any case, this international money transfer service provides a solid mobile app that you can use to initiate transfers, track their progress, and receive and keep funds in an online wallet.

Read our full MoneyGram review.

Honorable Mentions

Among the hundreds of international money transfer services, there are, of course, more than 11 that are worth a mention because of the amazing options they provide. That’s why we’re featuring 9 more international money providers below who are just as good as those that we’ve already reviewed.

1. Western Union

Pros:

- Most popular money transfer provider alongside MoneyGram

- Extensive global reach

- Experience of over 150 years in the industry

- Support for most currencies among similar providers

- Cash pick-up option available in thousands of locations

- High money transfer speed

- Hedging options for business users

Cons:

- High margins on exchange rates

- High transfer fees

- Doesn’t have the best online rankings

- Complaints about customer service

- Requires lots of documentation for small transfers

If you haven’t transferred money using Western Union before, chances are, you’ve surely heard about it at the very least. They are one of the oldest international money transfer companies in the world, dating back to 1871.

Western Union is also the most spread-out money transfer provider out there. They are present in every country in the world in over half a million locations. You can find them in banks, grocery stores, exchange offices, malls, etc.

Like MoneyGram, Western Union is more specialized in handling smaller money transfers in different currencies. They both do it in a fast manner so everyone can get their money in minutes. However, their exchange rates and transfer fees are pretty high, just like MoneyGram’s.

For everyone who wants to enjoy lower fees, we recommend using the Western Union mobile app, since initiating transfers with it usually comes with a $0 transfer fee.

Western Union is also focused on providing the ultimate safety for their customers, so they ask for more documentation during sign-up and transfer initiation.

It should be noted that Western Union imposes maximum transfer limits that are usually capped at $50,000. This is mostly for online transfer though. You can make larger money transfers if you visit one of their agent locations.

Read our full Western Union review.

2. Instarem

Pros:

- Great mobile app

- Many positive online reviews

- Favorable margins on exchange rates

- Convenient for customers in India

- Doesn’t charge transfer fee for most transfers

- Amazing user interface

- High transfer speed

Cons:

- Not suitable for large money transfers

- No customer support over phone

- No cash pick-up option

- Little experience due to being a newcomer

Instarem is one of the fintech newbies on the international money transfer scene valuing innovative technologies above all. Based in Singapore since 2014, this provider facilitates money transfers for everyone who wishes to send or receive funds in a simple, fast, and reliable way.

After achieving tremendous growth, Instarem has over 200 employees and 12 offices around the world today. They have been awarded multiple recognitions throughout their short existence, mostly from Asian and Australian financial institutions.

Instarem offers an amazing mobile app, putting a big focus on user experience and contemporary design. Like many modern fintech startups, they lack real customer support and rely on AI to assist customers with their needs. While this is the way forward, there are many who complain that they can’t resolve their issues on time.

Regarding costs, Instarem can be very affordable for most of its customers. Fees and rates depend on the sending and receiving countries and currencies, but most of the time there are no transfer fees.

Instarem also has a great rewards program. Customers can earn reward points for signing up, referring other users, and sending money. Then, they can redeem their reward points and add them to their transfer amount.

Read our full Instarem review.

3. Key Currency

Pros:

- No cap on the minimum and maximum transfer limits;

- No transfer fees;

- Most suitable for customers in Spain;

- Provides dedicated dealers;

- Favorable exchange rates;

- Hedging options for business users.

Cons:

- Not available in the United States;

- No mobile app is available;

- No cash pick-up option;

- Payments are available only through a bank account.

Key Currency is one of the newer services that provide money transfer services that show slow but promising growth. Founded in 2015 in Cornwall, the UK, this small enterprise develops its steady growth by facilitating investors who primarily purchase properties abroad.

One of the strongest Key Currency assets is their dedicated support staff. Each customer with a Key Currency account gets a personal account manager that gives advice on the best forex options, notifies when exchange rates are most favorable, and guides each international money transfer process.

This provider is suitable for making both small and large money transfers, although they mostly target customers in the UK and Spain who wish to make large purchases across borders. No matter the amount of the transfer or the chosen currencies, Key Currency doesn’t impose any transfer fees. They don’t limit the minimum and maximum amounts that customers can send to their recipients.

For business users, Key Currency provides a plethora of hedging options such as limit orders, scheduled payments, spot contracts, forward contracts, and alerts on rates. These can be very convenient for traders on the forex exchange.

While Key Currency might suit most customers in Europe, the service isn’t available for US citizens. Transfers are also only possible through bank accounts. They also don’t have a mobile app at the moment, however, their web platform is easy to use and provides high efficiency for making regular money transfers.

Read our full Key Currency review.

4. VertoFX

Pros:

- No cap on the minimum and maximum transfer limits;

- No transfer fees;

- Competitive exchange rates;

- Puts lots of focus on speed and bulk transfers;

- Provides dedicated dealers;

- Global reach to over 200 countries.

Cons:

- Money transfer services are available only for B2B customers;

- Requires lots of documentation for verification purposes;

- Customers testify to high third-party fees;

- Support for only 35 currencies;

- All features are available for UK and US customers only.

VertoFX is another international money transfer newcomer on our list. What makes it different from the rest of the services we included in this article is that VertoFX is exclusively a B2B marketplace and doesn’t serve customers who wish to transfer money for personal reasons.

Established by two ex-bankers in London in 2017, VertoFX simplifies international payments and money transfer processes for all types of businesses. So, whether you’re running a start-up or a large corporate-level firm, this provider offers competitive exchange rates that are much cheaper than going to a traditional bank and using their money transfer services.

With VertoFX, there are no transfer fees and minimum or maximum limits on transfers of any nature. So, no matter the amount of the transfer or which currency you wish to transfer to, rest assured that VertoFX won’t surprise you with any unexpected fees.

Additionally, VertoFX facilitates international FX payments about three times faster than ordinary banks. They are optimized for mass payments, so companies that need to pay teams of contractors abroad are in safe hands.

While they don’t provide a mobile app for anyone other than Android users, this money transfer provider offers a comprehensive browser-based app for all customers. There, they can oversee their transfers and contact their splendid customer support agents.

Read our full VertoFX review.

5. Moneycorp

Pros:

- One of the highest ratings in the industry;

- Operating since 1979;

- Great customer service;

- Numerous industry awards;

- Transparent rates and fees;

- Extensive global reach;

- No maximum transfer limit for business users;

Cons:

- Outdated mobile app;

- Requires lots of documentation for verification purposes;

- Not too suitable for customers in the US;

- Not too suitable for small money transfers.

With over 4 decades on the international money transfer scene, Moneycorp is an experienced provider with lots of market knowledge and expert guidance, helping everyone who wishes to send money to a foreign country.

Registering with Moneycorp is a bit more cumbersome than with other similar money transfer providers due to their requirements for legal documentation. However, taking care of all the legal sides of this process, Moneycorp ensures they add an extra layer of security to their services and prevent fraudulent activities from happening.

When it comes to their rates, Moneycorp’s transfer fees and margins on exchange rates are pretty competitive for most customers. This is not exactly the case for users in the United States because the transfers they make first need to be converted to British pounds and then to the currency their recipient receives. That accumulates more fees for them.

Other than that, there are tons of useful features that make Moneycorp one of the best alternatives for business users. They can integrate their API payment system on their online platforms and use it for bulk payments, recurring payments, and money orders. This ensures they get the best exchange rates and transfer money in a fast, secure, and reliable way.

On the downside, we’ve witnessed some negative online reviews regarding Moneycorp’s mobile app. They mention lagging and outdated user interface as disadvantages of using said app.

Read our full Moneycorp review.

6. CurrencyTransfer

Pros:

- Top-ranked on Trustpilot

- No transfer fees

- Offers selection of other money transfer providers to choose from

- Favorable for making large money transfers

- Additional services such as forward contracts and money orders

- Great customer service

Cons:

- No mobile app yet

- Limited number of currencies

- Not too suitable for small money transfers

CurrencyTransfer is a UK-based international money transfer aggregator that enables transfers by providing currency exchange rates from several government-approved money transfer providers. It is exceptionally well-rated on Trustpilot with 4.9 out of 5 star rating.

CurrencyTransfer is a marketplace oriented to service businesses, brokers, and personal users who wish to transfer large sums of money. They don’t have a cap on the amount of money you can send, and their exchange rate is what the provider that you’ve selected offers.

To make it easier for everyone to choose their best option among their high-profile providers, CurrencyTransfer displays current mid-market exchange rates. On top of that, they don’t impose any transfer fee on the transactions they handle. Besides, they take great care to inform you that your transaction won’t meet any hidden fees throughout the entire transfer.

This service enables transfers in about 30 different currencies and their transfer times range from 1 to 2 days, depending on the chosen currency and the origin and recipient countries.

CurrencyTransfer also offers a few additional services, such as spot contracts, forward contracts, and money orders which have the purpose of safeguarding your transactions from inflated exchange rates.

On the downside, CurrencyTransfer has no mobile app for easier account handling and the method of delivering the transfer money depends on which provider is chosen to move the transaction.

Read our full CurrencyTransfer review.

7. Caxton

Pros:

- Lots of positive online feedback;

- Provides its own prepaid ATM card;

- Fast card delivery;

- No fees for using the card for ATM withdrawals or foreign purchases;

- A multi-currency account;

- Competitive exchange rates;

Cons:

- Not suitable for domestic use;

- Only available to customers in the UK;

- Limited number of covered currencies;

- Some negative feedback about customer service and their mobile app.

Caxton is a money transfer company that’s famous for its multi-currency card that makes paying abroad easier and cheaper. Users can load this card in their preferred foreign currencies and whenever they travel somewhere, they can pay with it without being charged any fees by Caxton for their purchases or ATM withdrawals.

It should be noted that most ATMs charge their own fee for withdrawing money with a foreign card, so users should consider this before incurring any unexpected fees. Additionally, there are fees for using the card in your country of residence.

Caxton is based in London and they employ around 100 skilled financial experts. They are regulated by the FCA and HMRC in the UK, ensuring you’re in safe hands whenever you want to transfer money using one of their services.

Some disadvantages to Caxton include problems some users have reported while using its mobile app (its improvement is only a matter of time), its usage that’s only limited to the UK, its small number of covered currencies (only about 30), and its low maximum money transfer limits.

Caxton also includes a feature similar to hedging. Users can lock a fixed rate and not worry about exchange rate fluctuations. Caxton will additionally notify you of all current exchange rates so you can change your decision at any time.

Read our full Caxton Money Transfer review.

8. Global Reach

Pros:

- Experience of almost 2 decades in the industry;

- No cap on the maximum transfer limit;

- No transfer fee for larger money transfers;

- Extensive global reach;

- Supports over 140 different currencies;

- Great for both personal and business users;

Cons:

- No mobile app is available;

- Not available for users in the United States;

- High cap on minimum transfer limit.

Global Reach is one of the most sophisticated choices dealing with transferring money around the world. This company was founded in 2005 and has ever since its inception enhanced its functionality and grew to be an experienced veteran on the market.

Serving both corporate and private clients, Global Reach is a bit more suitable for making larger money transfers since their minimum transfer limit is £1,000 (or currency equivalent) and they impose no transfer fees for transfers over £3,000.

What’s more, this provider is very transparent about their costs and upon reaching out, they can notify you of all the fees and rate costs you’ll incur by initiating a transfer through them.

Global Reach excels particularly in the area of FX options and hedging for business users. In this field, they offer some services that are unavailable elsewhere. So, among features such as market orders, forward contacts, limit orders, stop loss, and risk reversal, they offer the window forward extra feature which allows protection for a certain exchange rate while still allowing for “moving up” the rate up to a fixed limit.

While Global Reach is big on website design, expert assistance for all of their clients, and maintaining a high level of security within their systems, they still have certain drawbacks. They’re not available for US customers yet, and as a company that facilitates innovative technology to aid their processes, they still lack a mobile app for easier and simpler access to their services.

Read our full Global Reach review.

9. Currency Solutions

Pros:

- Longstanding high rank on Trustpilot;

- Provides dedicated dealers for large money transfers;

- Great customer service;

- Lots of hedging options for business clients;

- No transfer fees for larger money transfers;

- Competitive exchange rates.

Cons:

- High cap on minimum transfer limit;

- Low cap on maximum transfer limit;

- Not too suitable for small money transfers;

- No mobile app is available.

For anyone looking to send money across borders in a fast, affordable, and reliable way, Currency Solutions might be the best option for them. This money provider can handle large international money transfers and make them available for the recipient within a day of sending.

Similar to Global Reach, Currency Solutions don’t impose any transfer fees for sending large amounts of money (over £3,000), but they do have a high cap on their minimum transfer limit of £100. Their maximum limits are also pretty low (£20,000 for private clients and £50,000 for business clients).

Currency Solutions’ positive online reviews come mostly from the fact that the company stays true to their word. With them, what you see is always what you get, and safety and reliability is their constant priority.

To help reduce the risks and costs that arise from market fluctuations, Currency Solutions provide a plethora of FX features such as spot contracts, forward contracts, recurring payments, and limit orders which have a main function of protecting your preferred exchange rate.

Signing up with Currency Solutions is quick and easy, and customers who aim to make large money transfers are assigned a dedicated dealer who handles all of their transfers and manages their account.

Read our full Currency Solutions review.

10. Revolut

Pros:

- Big on convenience, speed, and reliability;

- Quick registration process;

- Great mobile app;

- Provides different types of cards with low fees;

- Provides virtual cards for secure payments;

- Great customer service.

Cons:

- Many negative online reviews;

- Higher fees for international payments;

- Trading with crypto not regulated;

- High fees for card transfers outside Europe.

Revolut is one of the most popular online tools for handling international money transfers and payments. In fact, Revolut is a virtual bank and provides most of the services a traditional bank would (except they don’t have physical locations).

What puts them apart from traditional banks is their focus on new technologies and cryptocurrencies. Revolut is also very popular among expats and freelancers earning wages from international clients since they provide low transfer fees for smaller money transfers.

Their low fees make Revolut’s cards very suitable for traveling and spending abroad. Depending on the type of card, customers can make transfers and ATM withdrawals with no fee up to a certain amount on a monthly basis.

Revolut’s 15 million users testify of this fintech startup’s reliability and convenience. The ability to transfer cryptocurrencies and use them for purchases only boosts their popularity.

One of their best features that attracts lots of young clients is their virtual cards. These cards are generated for free and they can be used for online spending. They provide the ultimate safety since they can be destroyed after one-time payments or at any time through Revolut’s mobile app.

While there have been concerns over Revolut’s fast growth and lack of proper compliance in some areas, the banking service runs smoothly, and there haven’t been any reports of fraudulent activities. Most negative online reviews revolve around slow customer service response.

Read our full Revolut review.

Basic International Money Transfer Information

Let’s explain some of the terms we’ve used to describe the ranked services above, so you can have a better idea of what to look for when choosing the best option for you.

What Is an International Money Transfer?

An international money transfer is a way to send money from one country to another, typically through a financial institution or money transfer service. International money transfers can be used for a variety of purposes, such as paying bills, sending money to family or friends, or making cross-border business payments.

To initiate an international money transfer, you will typically need to provide the recipient’s name, their address, and bank account information (if applicable), as well as the amount of money you wish to send. You will also need to choose a payment method, such as a bank account, credit card, or cash, to fund the transfer.

There are many international money transfer services available, both online and through traditional financial institutions. We’ve covered 20 of those we deemed best after we compared their fees, exchange rates, and other terms and conditions among their many different services.

International Money Transfer vs. Bank Wire Transfer

An international money transfer and a bank wire transfer are both valid methods of sending money from one country to another. However, there are some differences between the two, including:

- Fees – International money transfer services may charge lower fees than banks for international wire transfers. However, the fees for both types of transfers can vary depending on the specific service or bank and the amount of funds being transferred.

- Documentation – Banks require much more paperwork than international money transfer providers. Besides the signup process, banks can also require documents for every transfer, and most would have clients come to their physical locations to confirm larger transfers.

- Exchange rates – Both international money transfer services and banks may offer different exchange rates for converting one currency to another, but providers are often cheaper in this regard. It’s important to compare the exchange rates offered by different services to find the best rate.

- Speed – International money transfer providers may offer faster transfer times than banks for international wire transfers, although actual transfer times can vary depending on the service and the countries involved.

- Payment methods – International money transfer services usually offer a wider range of payment methods, such as credit cards and online payment platforms, in addition to bank accounts. Banks typically only allow you to fund an international wire transfer with a bank account.

- Recipient options – Most international money transfer services offer more options for how the recipient can obtain the money, such as direct deposit to a bank account or cash pickup at a physical location. Banks may only allow the recipient to receive the money in their bank account.

Overall, both international money transfers and bank wire transfers can be useful options for sending money internationally, depending on your specific needs and preferences. It’s important to carefully research and compare different services to ensure you discover the best one that fits your requirements.

Are International Money Transfer Companies Safe?

International money transfer companies are a very safe and convenient way to send money internationally, as long as they’re verified by reliable regulatory agencies. In any case, it’s important to do your research and carefully compare different money transfer companies to find one that is trustworthy and meets your needs.

Here are a few steps you can take to ensure that you are using a safe international money transfer company:

- Check for regulatory compliance – Look for a money transfer provider that is regulated by financial authorities in the countries where you and the recipient reside (such as FinCEN in the US, FCA in the UK, ASIC in Australia, etc.). This can provide some assurance that the company is operating legally and following industry standards.

- Research the company’s reputation – Read online reviews and ask for recommendations from friends or family to get an idea of the company’s reputation. Companies with a history of satisfied customers and a good track record are usually a safe bet.

- Compare fees and exchange rates – Shop around and compare the fees and exchange rates offered by different money transfer services to find the best value. Double check companies that offer rates that seem too good to be true, as they could be hiding additional fees or charge more in other ways.

- Use a secure website or mobile app – When sending money online, make sure that the website or app you are using is secure. Look for the “https” prefix in the URL and check for a security icon, such as a padlock, to indicate that the site is encrypted.

- Protect your personal and financial information – Be careful not to share your personal or financial information with anyone you do not trust. When sending money online, make sure that you are using a secure website or app and only enter your information when prompted.

By following these guidelines, you can increase your chances of using a safe and reliable international money transfer company.

International Money Transfer vs. Currency Transfer

The two terms – international money transfer and currency transfer are often used interchangeably, referring to the process of transferring money from one country to another. However, some people and online outlets may use these terms with different meanings.

To get a better idea of how they differ, let’s take a look at their simple definitions:

International money transfer – An international money transfer is a way to send money between two countries, typically through a financial institution like a bank or a money transfer service. They can be used for a variety of purposes including moving permanent addresses from one country to another, sending money to friends or family, paying bills, making business payments, etc.

Currency transfer – A currency transfer, also known as a foreign exchange or forex transaction, is the process of transferring money between two currencies. Currency transfers are typically used to send money internationally, but they may also be used domestically, to exchange currencies for other purposes, such as making electronic payments for products or services in other countries, investing in foreign currencies, etc.

Depending on what your specific needs and preferences are, both international money transfers and currency transfers can be useful options for sending money internationally. However, if you’re interested in sending money to a different person or transfer your own into another country, we advise you to look for an international money transfer provider.

Third-Party International Money Transfer Companies

Third-party international money transfer services refer to financial services that are provided by companies that are not affiliated with a traditional bank but use banking infrastructure to conduct their services.

These providers operate through partnerships with banks and are used to supplement or replace traditional banking services.

While most of the providers on our list use bank infrastructure to send and receive payments, third-party international money transfer companies are usually used for business purposes. They are also referred to as brokerages as they are used by investors to make investments in their currency portfolio.

How Much Do International Money Transfer Services Cost

The cost of using an international money transfer service can vary depending on a number of factors. Initially, the costs depend on the specific service you are using. Additionally, other factors determine the cost of the service, including the country of origin of the money, the recipient country, the amount of money you are transferring, the payment methods, and the delivery methods you have chosen.

Banks may also charge fees for international money transfers in a similar fashion. Their fees can vary depending on the specific bank and the type of account you have.

The major costs of using a service by an international money transfer provider or a bank arise from the following:

- Transfer fees – Most transfer providers and all banks charge a flat fee or a percentage of the transfer amount as a fee for its international money transfer services. These fees can range from a few dollars to several hundred dollars, depending on the amount of money being transferred.

- Exchange rate fees – Banking and money transfer services may also charge a fee for converting one currency to another as part of an international money transfer. This fee is usually a percentage of the transfer amount but can be a fixed amount as well.

- Other fees – Additional fees for certain services or options, such as expedited transfer times or delivery methods may also be required by banks and international money transfer providers.

With that said, we found that banks charge more for fees for transferring money internationally. Their fixed transfer fees range between $10 and $30 and their exchange rate fees are significantly higher than those of international money transfer providers.

Additional International Money Transfer Information

Now that we’re gone through the basic information all those who want to use an international money transfer service should know, we can dive deeper into their domain. Below, we’ll see what their complete list of services is, how to choose the best one for you, compare important factors that matter when choosing one, and much more.

What Services Do International Money Transfer Companies Provide?

Companies that operate in the money transfer space usually provide a range of options that allow people to send money across borders. Sending money back home or to your friends, paying for tuition, paying bills, making business payments, paying offshore employees or contractors, or even paying to your own foreign bank account – there’s usually a service for any international money transfer need.

Whatever your need is, you can use one of the following to send money internationally in your preferred way:

- Bank transfers – Whenever you wish to send money to a bank account located in a different country, most providers offer this option even if you pay with a credit/debit card or with cash in store.

- Online payments – There are dozens of providers who make international online transfers available through their web platforms or mobile apps. This is usually the most convenient and fastest way to send and receive money electronically.

- Currency exchange – This option is useful for times when your recipient needs to receive the money in a different currency. Providers that specialize in this area usually have the best exchange rates, allowing you to convert currencies even when you’re doing it in your own account. This option is also useful for making personal and business payments for goods or services purchased from a different country.

- Cash pickups – Multiple international money transfer companies, especially the biggest and most accessible ones, offer recipients pickup options in any of their physical locations. Cash can be picked up at any of their designated offices or stores and they are usually supported by banks as well.

- Home deliveries – While companies of this type are rare, there are some, especially in developed countries, that provide home delivery services. Often associated with the highest fees, these providers allow recipients to get their money in the form of cash at their home or work address. This option is very convenient for sending money to elderly family or friends who are unable to visit a physical location.

How to Choose the Best International Money Transfer Company?

All of the international money transfer providers that we feature in this article are similar to one another. However, their minor differences can mean a lot, especially if you’re sending large sums of money or making regular transfers.

For instance, if you want to gift a friend who lives overseas $300 in cash, it might not matter much which service you’ll decide to go for. But, if you’re planning to move and want to transfer all of your savings to a different bank account in a different currency or if you’re a business owner who needs to pay tens of thousands to contractors, choosing the right money transfer provider is crucial.

First things first, you need to narrow down your options:

- Look at providers who specialize in the particular service you need.

- Dive into online reviews by real customers and review sites that craft elaborate analyses.

- Understand their payment methods, transfer fees, and exchange rates.

- Create online accounts with the providers that offer what suits you the best.

- If necessary, schedule a call with representatives to confirm key information and verify their level of professionalism.

- Make a chart of your pool of options along with their pros and cons.

- Go for the one with the most pros and the least cons.

If your gut is telling you that you can’t trust a provider 100%, then you’re probably right and they might not be suitable for you. You can’t commit your funds to an international money transfer company if you don’t trust them.

A sophisticated provider will come to your aid to help you with your transfers and notify you of the times when the exchange rate you’re interested in is most favorable.

If you’re interested in making regular money transfers, ask for a Forward Contract – a popular tool for private clients and small businesses. You can also negotiate better exchange rates if you need to transfer large amounts of money or commit to regular transfers.

After the first of your transactions goes through, double-check if you’re satisfied with how things went down. Keep a close eye on the rates the company provides for you and occasionally compare them to other money transfer providers. With time, new options emerge on the market that offer innovative solutions using more advanced technology, so make sure you always stay informed.

As a matter of fact, you can sign up with two or three money transfer providers instead of only one. That way, you’ll always have a chance to compare their rates and fees in real time.

What Type of Fees Do International Money Transfer Companies Impose?

We’ve already touched upon some fees that you’ll be dealing with when interacting with an international money transfer service. Now, we’ll do a deep dive into all of their implications and teach you more about their importance.

Transfer Fees

This type of fee is the most basic one and easiest to understand. Simply put, it’s a fee that your international money transfer provider or bank might ask to initiate each transfer. To attract more customers, many services don’t include transfer fees. However, they always need to make a profit in some way, so if they don’t have transfer fees, the chances are they are compensating in another way.

Transfer fees are always added to the entire amount of money that you’re willing to send. For example, if you want to send $1,000, there could be a transfer fee of $10 which will be added to the initial amount. So, the recipient will still receive $1,000 but you would have to pay $1,010.

Transfer fees can be flat or depend on the amount of money that you’re sending, the origin country and the recipient country, the currencies involved, and the speed of processing.

Exchange Rate

When your transfer involves a conversion of currencies, whether that’s in one country or between two countries, your money transfer provider imposes an exchange rate. This is where international money transfer services make most of their profits since they charge higher exchange rates than those set by central banks and the stock exchange.

For example, if the United States dollar converts to £0,831 British pounds, according to the stock exchange that means that your recipient will receive £831 pounds if you send them $1,000 dollars. However, your money transfer provider can impose a 0.6% margin on that price, so for $1,000 dollars, the recipient would receive £826 pounds.

Sending Fees

Sometimes you can confuse this type of fee with the transfer fee. As a matter of fact, they are the same thing. Some international money transfer companies use the term “transfer fee” and others “sending fee”.

Receiving Fees

While not too common, there are international money transfer companies that charge a receiving fee. This is paid by the recipient when they need to accept the transfer or pick up the money in the form for cash from a physical location.

Some companies charge this fee instead of a transfer fee, but there are those that charge both as well. That means that they are making a bigger profit from each transfer, taking money from the sender and also the receiver.

Important International Money Transfer Factors

There are multiple factors to consider when deciding whether to use an international money transfer service or when choosing a specific provider that seems like it provides the most suitable service for you.

Let’s review them!

Consider the Transfer Amount

The amount of money you wish to transfer is an important factor to consider when selecting a money transfer provider. If you plan on sending only small amounts of money, you will discover that there are more options out there available to you.

However, if you are planning to transfer a large sum of money, you may benefit from using a company that specializes in handling business transfers. For amounts of money that are outstanding, it may be best to avoid using banks as they usually charge the highest fees for making international money transfers.

Comparing Transfer Fees

It’s important to compare the fees charged by different banks and companies for international money transfers to find which impose transfer fees and how high they are. You can then decide which of those services you want to use based on your preferences.

For instance, if you’re making a small transfer that’s not time-sensitive, paying a transfer fee might not make the service worthwhile. Sending $50 or $100 in cash as a holiday gift can be the cheapest if done through snail mail.

On the other hand, if you need to send a large amount of money urgently, the fees may be worth it. For example, if you need to urgently send $3,000 to a relative for an emergency intervention, the transfer fee shouldn’t hold you back from using a fast service. Also, when sending tens of thousands, the transfer fees won’t make any difference.

Comparing Exchange Rates

As we already mentioned, being knowledgeable about current exchange rates is crucial if you want to benefit the most from using a reliable money transfer service. Recently, there have been new laws and regulations put in place to protect customers from exposure to inflated exchange rates by banks and other institutions. However, even reasonable but different exchange rates can make a huge impact on how much the recipient gets.

With that said, you need to double-check the accurate exchange rates and check online to see how different providers set theirs. That way you can ensure you’re on a good path in choosing a suitable international money transfer company to bring the most benefit to your recipient.

Comparing International Money Transfer Providers

Besides comparing the two big factors already mentioned (the exchange rate and transfer fees), there are also a few other things you should pay close attention to when searching for the most suitable international money transfer provider for you. Let’s single them out.

- Review the total costs of your transfer. That will be the overall cost after all the fees and rates have been calculated and added on;

- Don’t immediately dismiss a provider without first checking if they offer any online coupons or special promotions that can lower the extra costs on your total transfer;

- Consider the speed of the transfer. For convenient and urgent needs, fast transfers are favorable, but usually come at a higher transfer fee. Checking transfer speed beforehand makes it easier to decide if a provider satisfies your criteria;

- Find out about providers’ canceling policies. In some cases, you might want to cancel or postpone your transfer, so knowing if your provider provides that option (and the length of it) can help you avoid unnecessary stress;

- Check out online reviews. Seeing what real customers have to say about the money transfer companies that you’re interested in can be very eye-opening. That way, you can learn about important services such as customer service, speed, safety, additional costs, hidden fees, etc.

Why Should I Use an International Money Transfer Company Instead of a Bank?

There are several reasons why we believe that international money transfer companies are a better choice than banks for sending money abroad. We’re listing them below:

- International money transfer providers cost less than banks. Banks deal with much more than handling cross-border money transfers, so they already have a big clientele using their other services. That’s why they can allow themselves to push higher exchange rates and transfer fees since their clients already use them and many of them will make a cross-border money transfer with them out of convenience.

With that in mind, international money transfer companies need to keep their rates and fees a bit lower than banks if they want to attract new customers. - International money transfer providers are experts in their field. They send and receive money all the time, so it’s natural for them to know all the quirks and squeezes of the business. Having years of experience allows them to provide quality services and the best rates on the market.

- International money transfer providers are time-efficient. They usually require less paperwork than banks and everything can often be submitted online. Recipients can also save time by not having to deal with a bank and getting their money through a mobile app or simply visiting a physical location where they can withdraw the transfer in minutes.

How to Use an International Money Transfer Company to Send Money?

Finally, let’s discuss the easy steps that are required to initiate and complete an international money transfer.

- First, make an online account by accessing the provider’s mobile app or website. To do so, you’ll be required to provide your name, email address, and possibly your phone number and home address;

- Next, to make a transfer, you’d first need to verify your identity. You can do this by providing a copy of your ID or passport photo. Additional proof may be required by the provider such as proof of address and bank account number. Companies do this to protect you from fraud or cyber theft;

- Proceed to make a transfer. You can do this online, by phone, or in person. You will also need to connect your credit/debit card or your bank account number (BIC, SWIFT, and/or IBAN) to your account unless you’re paying with cash in person;

- You will also need the recipient’s bank account number unless they have an online account already connected with a credit/debit card or a bank account. You also don’t need their information (besides their name and address) if they wish to pick up the money in cash.

- Track the transfer progress in your app or on the company’s website to ensure everything runs smoothly and as intended;

- Double-check with the recipient if they have received the transfer. That’s it!

Conclusion

International money transfer services are a great alternative to banks when you want to send money abroad in a fast, reliable, and cheaper way.

This article explains all about the service and which factors matter the most when making an international transfer.

We also list the top international money transfer providers with all their pros and cons, so you can easily overview their offers and conditions. That way, you can hopefully come to an easy decision about which one to use and make the most out of your time and money.

FAQs

How many international money transfer services are there?

It’s difficult to provide an exact number of international money transfer services, as new ones may constantly be emerging and others may be retiring. In addition, different sources may define “international money transfer service” in slightly different ways, so it’s possible that some sources might include or exclude certain services.

That being said, there are likely dozens, if not hundreds of international money transfer services available. These can range from well-known, established companies to smaller, newer firms.

Some of these services may only operate in certain countries or regions, while others may have a global reach.

It’s important to research and compare the fees, exchange rates, and other terms and conditions of different services to find the one that best meets your needs.

Can I use any of the best international money transfer companies online?

Yes, many of the best international money transfer companies offer online services that allow you to transfer money internationally through their website or mobile app. This can be a convenient option if you don’t have a physical location nearby or if you prefer to handle your financial transactions online.

To use an online international money transfer service, you will typically need to create an account and provide some personal and financial information.

You will also need to have a payment method set up, such as a bank account or credit card, to fund the transfer.

Once you have completed these steps, you can usually initiate a transfer by entering the recipient’s information and the amount you wish to send.

That’s why it’s crucial to compare different online international money transfer services to find one that is reliable, has competitive fees and exchange rates, and offers the features and services that you need.

Some factors to consider when choosing an online international money transfer service include the countries they serve, the types of currencies they support, the speed of the transfer, and the available payment and delivery options.

How long will it take for an international money transfer to be completed?

The time it takes for an international money transfer to be completed can vary depending on a number of factors, including the specific money transfer service you are using, the countries involved, and the payment and delivery methods you have chosen.

In general, international money transfers can take anywhere from a few minutes to several days to complete. Some services may offer faster options for an additional fee, while others may have slower transfer times due to regulatory or other requirements.

It’s important to check with the specific money transfer service you are using to get a more accurate estimate of how long your transfer is likely to take. Some services may also offer tracking or notification features that allow you to follow the progress of your transfer.

What can I do to get a great exchange rate when I use an international money transfer service?

To score the best exchange rates when sending money cross-border, it’s crucial to do your own research and compare different providers.

You can check out the market trends for the country where you’re planning to send money and look for times or patterns when the exchange rate is most favorable. There are many online tools that can facilitate your research in this matter.

You can also look for promotions and best price guarantees offered by different providers. You should consider using a company that offers locked-in rates. If you want to avoid getting a poor exchange rate, you can postpone sending money when rates are particularly low.

Make sure to check if it’s possible to make a transfer in the same currency. That would eliminate your fear about getting a high exchange rate altogether.