Both Wise and MoneyGram are popular international money transfer services. But which one is better?

Below we compare them on their fees and reviews.

Fees

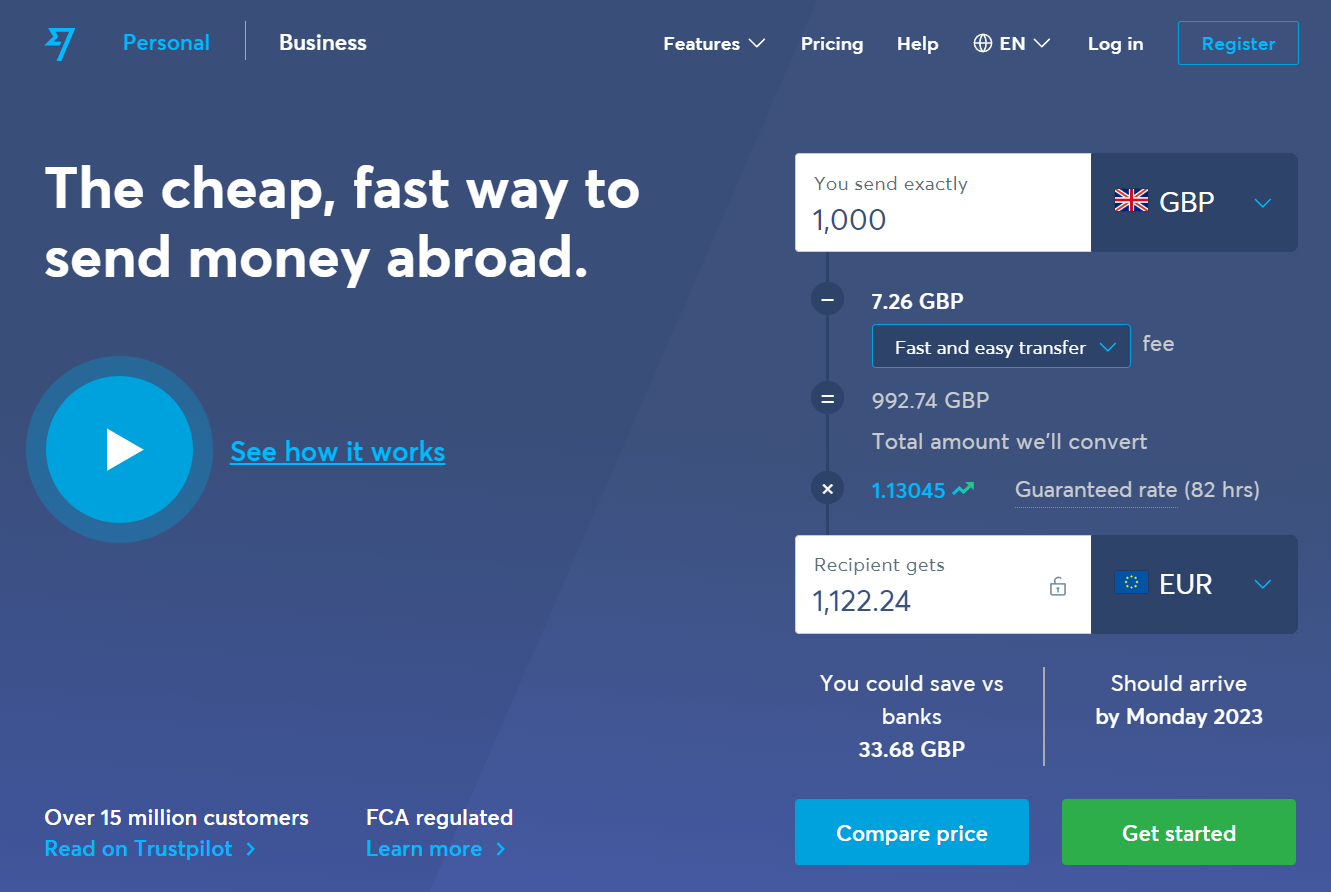

| Wise | MoneyGram | |

| Homepage |  |  |

| Transfer Fee | Variable fee – 0.4% – 0.6% of total amount (on average) Fixed fee – £0.2 – £0.3 on average. | Depends on the location, the sending amount, and the payment method. Can be as low as $0-$15 and as high as $100. |

| Average Exchange Rate Markup | No markup | 1% to 5% |

| Minimum Transfer Amount | $1 | £50 |

| Maximum Transfer Amount | $6,000,000 USD $1.8 million AUD $1.5 million CAD €6,000,000 EUR £5,000,000 GBP | $10,000 per online transfer for most countries (with a $10,000 as a monthly cap) $25,000 for online transfers to 42 select countries from the US. |

Top Rated Money Transfer Service

Currencies Direct are the top rated International Money Transfer Service on our list.

- 4.9 out of 5 on Trustpilot based on over 8,000 reviews

- No transfer fees

- Bank-beating rates

- Award-winning service

- Exclusive Amazon gift card offer for users of MoverDB.com

Reviews

| Wise | MoneyGram | |

| Trustpilot Rating | 4.3 | 4.5 |

| Number of Trustpilot Reviews | 193,700 | 34,800 |

| iOS App Rating | 4.6 | 4.9 |

| Number of iOS App Reviews | 29,500 | 422,000 |

| Android App Rating | 4.7 | 4.6 |

| Number of Android App Reviews | 503,000 | 88,000 |

Features

| Wise | MoneyGram | |

| App Transfers | Yes | Yes |

| Online Transfers | Yes | Yes |

| Phone Transfers | No | No |

| In-person Transfers | No | Yes |

| Available Countries | 170 | 200 |

| Number of Currencies | 50 | 60 |

| Payment Methods | Bank account Debit card Credit card Direct debit Apple Pay Google Pay iDeal Trustly SOFORT POLi PayPal | Bank account Debit card Credit card Cash |

| Receiving Methods | Online wallet Bank account | Online wallet Bank account Cash pickup Home delivery |

| Cash Pickup Option | No | Yes |

| Payments Flexibility | Web platform Mobile app | Web platform Mobile app In person |

| Supported Languages | English, Spanish, French, Portuguese, Italian, German, Chinese, Japanese, Indonesian, Hungarian, Ukrainian, Polish, Romanian, Turkish, and Russian | English, Spanish, French, German, Italian, Portuguese, Danish, Norwegian, Arabic, Russian, Ukrainian, Japanese, Czech, Turkish, Hungarian, Polish, Romanian, Indonesian, Thai, Korean, Malaysian, and Chinese |

| Transfer Speed | 0-2 days (within minutes for over 50% of transfers). | Within minutes (cash transfers) 1-3 days (bank and debit card transfers) |

| Dedicated Dealer | No | No |

| Instant Custom Quote | Yes | Yes |

| Business Features | Recurring transfers Batch payments Invoicing Multi-user access Digital multi-currency wallet Rate alerts API integration | N/A |

| Debit Card | Wise multi-currency debit card | None |

| Cancellation Policy | Users can cancel a transfer as long as they’re able to see the “cancel transfer” option on their transfer | Cancellations are possible as long as the money hasn’t been claimed by the recipient. |

| Suitability | Small money transfers | Small money transfers |

Top Rated Money Transfer Service

Company Comparison

| Wise | MoneyGram | |

| Year Founded | 2011 | 1940 |

| Headquarters | London, UK | Dallas, TX, US |

| Other Office Locations | London (UK), Austin, Dallas, Tampa, and New York (USA), Bangkok (Thailand), Dubai (UAE), Riyadh (Saudi Arabia), Hong Kong (Hong Kong), Shanghai (China), Singapore (Singapore), Tokyo (Japan), Seoul (South Korea), Jakarta (Indonesia), Kuala Lumpur (Malaysia), Manila (the Philippines), Mumbai (India), Brussels (Belgium), Budapest (Hungary), Cherkasy (Ukraine), Tallinn and Tartu (Estonia), Zürich (Switzerland), São Paulo (Brazil), Mexico City (Mexico), Cape Town (South Africa), Sydney and Melbourne (Australia) | Denver (Colorado, US), Minneapolis (Minnesota, US), Brussels (Belgium), São Paulo (Brazil), Vancouver (Canada), Shanghai (China), Hong Kong (China), Mumbai (India), Jakarta (Indonesia), Dublin (Ireland), Rome (Italy), Mexico City (Mexico), Warsaw (Poland), Singapore, Madrid (Spain), Istanbul (Turkey), and London (UK) |

| Annual Trading Volume | £76.4 billion | N/A |

| Number of Employees | 4500 | 2500 |

| Number of Clients | 16 million | 150 million |

| Regulatory Institutions | FinCEN in the USA FINTRAC in Canada FCA in the UK ASIC in Australia National Bank of Belgium in the EU | New York State Department of Financial Services in the USA FINTRAC in Canada FCA and HMRC in the UK National Bank of Belgium in EU |

| Awards | Best European Startup Under 3 Years Old (Europas, 2013) One of The World’s Top 10 Most Innovative Companies in Finance (Fast Company Magazine, 2014) Boldest Smaller Company (FT’s Boldness in Business Awards, 2014) Ernst and Young UK Entrepreneurs (2015) Top 20 out of 50 on Glassdoor’s Best Places to Work in the UK (2022) Made it in the FinTech50 list (in 2013, 2014, 2017, 2018, 2019, and 2021) | Best Cash Innovation and Best Comeback Story (PYMNTS Innovator Awards, 2016 and 2017) Technology Innovation Award (Asian Bankers, 2017) Money Transfer Awards (Mobex Africa Innovation, 2018) Top 100 Places to Work (The Dallas Morning News, 2021) Top Workplaces USA Award (Top Workplaces, 2022) Best Use of Blockchain in FinTech (FinTech Breakthrough Awards, 2023) |

Wise Pros & Cons

Wise Pros

- No markups on exchange rates

- Comprehensive global service reach

- Impressive currency support

- Widespread local presence with branches in more than 28 countries

- Custom quotes are available without signup

- Diverse payment methods encompassing bank accounts, debit and credit cards, PayPal, and more

- Highly rated on Trustpilot

- In-depth knowledge repository

- Ideal for small transactions

- Fast money transfers, with half of all transactions completed in minutes and the rest within 0-2 days

- Outstanding web platform and mobile app experience

Wise Cons

- Some Challenges with customer service

- Cash pickup isn’t an option

- Lack of dedicated currency dealers

- Less-frequented countries and currencies might incur high transfer fees

- Inadequate for large monetary transfers

- No support for lesser-traded currencies

MoneyGram Pros & Cons

MoneyGram Pros

- A vast range of payment methods

- Outstanding customer support

- Impressive rating on Trustpilot

- Diverse options for receiving funds

- Availability of cash pickup

- Extensive global presence, covering over 200 countries and territories

- Robust currency portfolio including 58 different major currencies

- A top-rated mobile application

- Extensive industry experience

- Swift money transfer services

- Loyalty rewards program

MoneyGram Cons

- Less ideal for handling large financial transfers

- Limited maximum transfer amounts

- A possibility of substantial transfer fees

- Above-average exchange rate markups

- Lack of hedging options for businesses

Top Rated Money Transfer Service

See More Comparisons:

Wise vs Remitly

Wise vs OFX

Wise vs Currencies Direct

Wise vs CurrencyFair

Wise vs TorFX