Both Wise and CurrencyTransfer are popular international money transfer services. But which one is better?

Below we compare them on their fees and reviews.

Fees

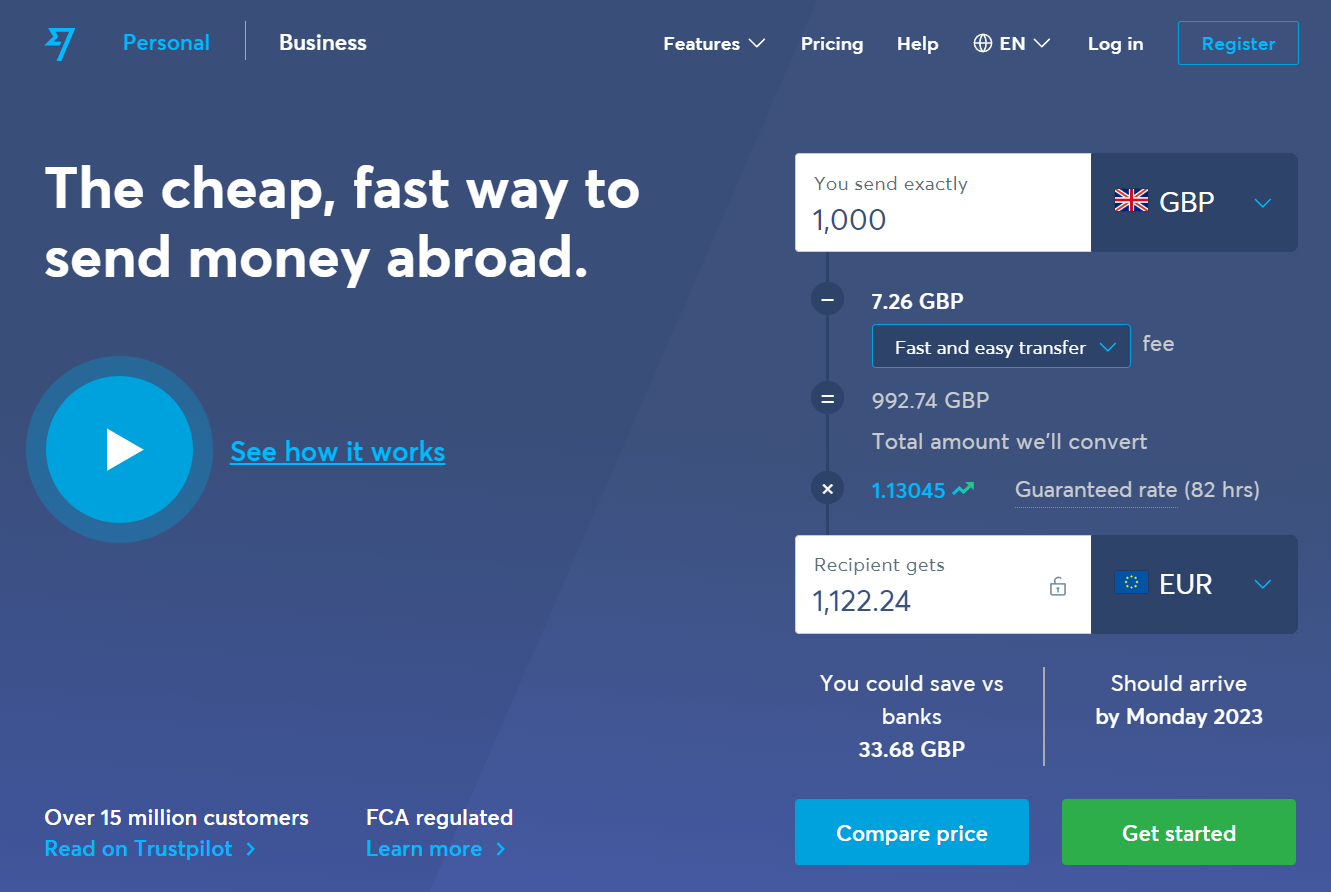

| Wise | CurrencyTransfer | |

| Homepage |  |  |

| Transfer Fee | Variable fee – 0.4% – 0.6% of total amount (on average) Fixed fee – £0.2 – £0.3 on average. | No fee |

| Average Exchange Rate Markup | No markup | 0.007 |

| Minimum Transfer Amount | $1 | £5,000 (or currency equivalent) |

| Maximum Transfer Amount | $6,000,000 USD $1.8 million AUD $1.5 million CAD €6,000,000 EUR £5,000,000 GBP | No limit |

Top Rated Money Transfer Service

Currencies Direct are the top rated International Money Transfer Service on our list.

- 4.9 out of 5 on Trustpilot based on over 8,000 reviews

- No transfer fees

- Bank-beating rates

- Award-winning service

- Exclusive Amazon gift card offer for users of MoverDB.com

Reviews

| Wise | CurrencyTransfer | |

| Trustpilot Rating | 4.3 | 4.8 |

| Number of Trustpilot Reviews | 193,700 | 900 |

| iOS App Rating | 4.6 | N/A |

| Number of iOS App Reviews | 29,500 | N/A |

| Android App Rating | 4.7 | N/A |

| Number of Android App Reviews | 503,000 | N/A |

Features

| Wise | CurrencyTransfer | |

| App Transfers | Yes | No |

| Online Transfers | Yes | Yes |

| Phone Transfers | No | No |

| In-person Transfers | No | No |

| Available Countries | 170 | 170 |

| Number of Currencies | 50 | 28 |

| Payment Methods | Bank account Debit card Credit card Direct debit Apple Pay Google Pay iDeal Trustly SOFORT POLi PayPal | Bank account |

| Receiving Methods | Online wallet Bank account | Bank account |

| Cash Pickup Option | No | No |

| Payments Flexibility | Web platform Mobile app | Web platform |

| Supported Languages | English, Spanish, French, Portuguese, Italian, German, Chinese, Japanese, Indonesian, Hungarian, Ukrainian, Polish, Romanian, Turkish, and Russian | English |

| Transfer Speed | 0-2 days (within minutes for over 50% of transfers). | 1-4 days |

| Dedicated Dealer | No | Yes |

| Instant Custom Quote | Yes | Yes |

| Business Features | Recurring transfers Batch payments Invoicing Multi-user access Digital multi-currency wallet Rate alerts API integration | Spot contracts Forwards contracts Market orders Batch payments FX derivatives Rate alerts API integration |

| Debit Card | Wise multi-currency debit card | None |

| Cancellation Policy | Users can cancel a transfer as long as they’re able to see the “cancel transfer” option on their transfer | Booked currencies can be bought back from the selling provider with the costs falling on the customer |

| Suitability | Small money transfers | Large money transfers |

Top Rated Money Transfer Service

Company Comparison

| Wise | CurrencyTransfer | |

| Year Founded | 2011 | 2015 |

| Headquarters | London, UK | London, UK |

| Other Office Locations | London (UK), Austin, Dallas, Tampa, and New York (USA), Bangkok (Thailand), Dubai (UAE), Riyadh (Saudi Arabia), Hong Kong (Hong Kong), Shanghai (China), Singapore (Singapore), Tokyo (Japan), Seoul (South Korea), Jakarta (Indonesia), Kuala Lumpur (Malaysia), Manila (the Philippines), Mumbai (India), Brussels (Belgium), Budapest (Hungary), Cherkasy (Ukraine), Tallinn and Tartu (Estonia), Zürich (Switzerland), São Paulo (Brazil), Mexico City (Mexico), Cape Town (South Africa), Sydney and Melbourne (Australia) | Tel Aviv (Israel) |

| Annual Trading Volume | £76.4 billion | $500 million |

| Number of Employees | 4500 | 23 |

| Number of Clients | 16 million | 20000 |

| Regulatory Institutions | FinCEN in the USA FINTRAC in Canada FCA in the UK ASIC in Australia National Bank of Belgium in the EU | FCA and HRMC in the UK |

| Awards | Best European Startup Under 3 Years Old (Europas, 2013) One of The World’s Top 10 Most Innovative Companies in Finance (Fast Company Magazine, 2014) Boldest Smaller Company (FT’s Boldness in Business Awards, 2014) Ernst and Young UK Entrepreneurs (2015) Top 20 out of 50 on Glassdoor’s Best Places to Work in the UK (2022) Made it in the FinTech50 list (in 2013, 2014, 2017, 2018, 2019, and 2021) | Top 9 Startups (Swift Innotribe Startup Challenge, 2014) Presented at FinovateEurope – a FinTech-based conference (2014) |

Wise Pros & Cons

Wise Pros

- No markups on exchange rates

- Comprehensive global service reach

- Impressive currency support

- Widespread local presence with branches in more than 28 countries

- Custom quotes are available without signup

- Diverse payment methods encompassing bank accounts, debit and credit cards, PayPal, and more

- Highly rated on Trustpilot

- In-depth knowledge repository

- Ideal for small transactions

- Fast money transfers, with half of all transactions completed in minutes and the rest within 0-2 days

- Outstanding web platform and mobile app experience

Wise Cons

- Some Challenges with customer service

- Cash pickup isn’t an option

- Lack of dedicated currency dealers

- Less-frequented countries and currencies might incur high transfer fees

- Inadequate for large monetary transfers

- No support for lesser-traded currencies

CurrencyTransfer Pros & Cons

CurrencyTransfer Pros

- Real-time personalized quotations

- Excellent client support

- Strong rating on Trustpilot

- Zero fees on transfers

- Attractive foreign exchange rates

- Worldwide service availability

- Wide range of options for businesses

- Speedy transfer of funds

- Notifications for exchange rate fluctuations

CurrencyTransfer Cons

- Not suitable for small money transfers

- High minimum transfer limit

- No multi-language support

- Limited payment options

- No mobile app

- Limited currency coverage

- No local coverage

Top Rated Money Transfer Service

See More Comparisons:

Wise vs WorldRemit

Wise vs Send Payments

Wise vs Instarem

Wise vs Key Currency

Wise vs VertoFX