The Netherlands – the land of tulips, windmills, and some seriously advanced banking tech. But even here, in this haven of financial innovation, moving your money can sometimes feel like you’re trying to navigate an Amsterdam canal without a paddle.

Now, we all know that in today’s digital era, the ease and safety of transferring funds is just as crucial as finding a good parking spot in a city designed exclusively for bicycles. You don’t want to lose a chunk of change thanks to sketchy services or, worse, end up paying “small” fees that total more than your last shopping spree.

So, stick around as we spill the tea on the 10 best money transfer companies in the Netherlands that tick all these boxes and more. We’ll even include all of the pros and cons that surround them and add a few extra FAQs just in case you miss something in the myriad of features these services offer.

Time to make your money move as smoothly as a Dutch speed skater on ice!

How to Choose the Best Money Transfer Company in the Netherlands

So how do you spot the Ferraris of the money transfer world from the rickety old bikes?

Keep your eyes peeled for a few key features:

- A transparent fee structure (no one likes hidden costs);

- Competitive exchange rates (because every cent counts);

- Lightning-fast transfer speeds (time is money after all);

- A vast coverage of countries and currencies (having more options always comes in handy);

- A reliable customer service (that actually serves the customer);

- Positive customer reviews (personal experiences always count more than vague promises).

Before we overview the top 10 money transfer services in the Netherlands that score big on all of these points, let’s take a look at what’s in for the ordinary Dutch resident in terms of sending and receiving money in the near future.

Overview of the Money Transfer Landscape in the Netherlands

Let’s first zoom out for a second and get a bird’s-eye view of the money transfer landscape in the Netherlands. We’re glad to announce that it’s steadily booming! Whether it’s freelancers collaborating with global clients, expats sending remittances, or businesses operating internationally, the market is on fire.

With the rise of ecommerce and cross-border ventures, this trend is showing no signs of slowing down.

Now, what’s shaking up this scene? For starters, the Dutch are a tech-savvy bunch. They’re quicker to adopt new financial technologies than the rest of the world! This enthusiasm for tech fuels a highly competitive environment that pushes companies to offer faster, cheaper, and more reliable services.

Plus, the Netherlands is a major player in the international trade game, which just adds another layer of substance to the already buzzing money transfer sector.

And let’s not forget the expat community! With nearly 200 nationalities calling the Netherlands home, there’s a hefty demand for affordable and easy ways to send money to family and friends living overseas.

As for the rules and regulations regarding this sector – the Dutch financial authorities have got everything under control. They, alongside other international regulatory bodies, ensure everything’s above board.

The Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM) are the big guns here. They make sure that companies toe the line when it comes to customer protection and anti-money laundering procedures.

Additionally, many money transfer companies in the Netherlands are part of wider EU regulations, which means added layers of security.

Given that, the Dutch regulatory framework is robust enough to ward off the scammers while letting the legit players flourish.

So, now that the stage is finally set, let’s dive into everything that the 10 best money transfer companies in the Netherlands have to offer.

Comparison of the Top 10 Money Transfer Companies in the Netherlands

Key Details

| No. | Provider Name | Founded | Trustpilot rating | Countries Covered | Currencies Covered | Transfer Speed | Cash Pickup | Mobile App |

| 1 | Wise | 2011 | 4.3 | 170 | 50 | 0-2 days (within minutes for over 50% of transfers). | No | Yes |

| 2 | XE | 1993 | 4.3 | 170 | 50 | 1-4 days | Yes | Yes |

| 3 | CurrencyFair | 2009 | 4.3 | 150 | 20 | 0-5 days | No | Yes |

| 4 | Western Union | 1851 | 3.9 | 200 | 130 | Within minutes for cash or debit card transfers; 1-3 days for transfers between bank accounts. | Yes | Yes |

| 5 | WorldRemit | 2010 | 4.1 | 145 | 70 | 0-2 days (within minutes in 95% of cases). | Yes | Yes |

| 6 | OFX | 1998 | 4.3 | 190 | 55 | 1-4 days | No | Yes |

| 7 | Revolut | 2015 | 4.3 | 200 | 29 | Instant for Revolut users; 1-2 days for the rest. | No | Yes |

| 8 | MoneyGram | 1940 | 4.5 | 200 | 60 | Within minutes (cash transfers); 1-3 days (bank and debit card transfers). | Yes | Yes |

| 9 | Remitly | 2011 | 4.1 | 180 | 75 | Within minutes (express delivery); 3-5 days (economy delivery). | Yes | Yes |

| 10 | Key Currency | 2016 | 4.9 | N/A | 37 | 1-2 days | No | No |

Fees, Rates, and Limits

| No. | Provider Name | Transfer Fee | Exchange Rate Margin | Minimum Transfer Amount | Maximum Transfer Amount |

| 1 | Wise | Variable fee – 0.4% – 0.6% of total amount (on average); Fixed fee – £0.2 – £0.3 on average. | No markup is added to the mid-market exchange rate. | £1 | $6,000,000 USD; $1.8 million AUD; $1.5 million CAD; €6,000,000 EUR; £5,000,000 GBP. |

| 2 | XE | £2.00 under £250 (UK); €2.00 under €250 (EU); No fee for other sums. | 0.2% to 1.4% added to the mid-market exchange rate. | £1 | £350,000 (UK and EU); $535,000 (US); CAD $535,000 (Canada); NZD $750,000 (New Zealand). |

| 3 | CurrencyFair | £2.50 (UK); €3 (EU); Currency equivalent for other currencies. | 0.45% added to the mid-market exchange rate | £7 (or currency equivalent) | 10,000,000 (same in every available currency) |

| 4 | Western Union | Based on the sender’s location, transfer amount, and payment method. Usually, there’s a fee that’s as low as $0-$15, but some can be as high as $100 if sending to an exotic location or paying by credit card. | 1% – 5% added to the mid-market exchange rate. | $1 | Depending on the sender’s country: $50,000 if identity verified; $3,000 if identity isn’t verified. |

| 5 | WorldRemit | $0.99 – $3.99 depending on the transfer amount and the selected countries and payment methods. | 0.5% – 2.5% added to the mid-market exchange rate (1% – 1.6% on average). | $1 | Depends on the selected countries and method of payment (ranges between $1,400 and $60,000). |

| 6 | OFX | AU$15.00 under $10,000 (Australia); CAD $15.00 under $10,000 (Canada); HK $60.00 under $50,000 (Hong Kong); NZD $15.00 under $10,000 (New Zealand); No fee for the rest of the world. | 0.4% – 1.9% added to the mid-market exchange rate. | $1000 in the US; £100 in the UK; €2 in the EU; $150 in Hong Kong and Singapore; AU$250 and its currency equivalent in the rest of the world. | No limit |

| 7 | Revolut | No fee for transferring to other Revolut users; Card transfers: 0.7% (if you’re in Europe) 2.3% (outside Europe) Bank transfers: fees can range between 0.35% and 1%. | A 0.5% – 2% markup is added to the mid-market exchange rate on weekends. There is usually no markup added on weekdays. | £1 | Depends on the selected plan, the sending country, and the recipient country. |

| 8 | MoneyGram | Depends on the location, the sending amount, and the payment method. Can be as low as $0-$15 and as high as $100. | 1% to 5% added to the mid-market rate. | $1 | $10,000 per online transfer for most countries (with a $10,000 as a monthly cap); $25,000 for online transfers to 42 select countries from the US. |

| 9 | Remitly | $0.00 – $50 depends on the selected countries, the transfer amount, and the payment method ($3.00 – $7.00 on average). | 1% – 2.5% added to the mid-market rate on average (can range between 0.5% and 3.7%). | $1 | Depends on the sending and receiving country, the transfer amount, and the transfer method (from $3,000 to £150,000). |

| 10 | Key Currency | No fee | 0.2% – 1% added to the mid-market exchange rate | £1 | No limit |

Review of the 10 Best Money Transfer Companies in the Netherlands

1. Wise

| Pros | Cons | |

|---|---|---|

| 1. | No markups on exchange rates | No support for lesser-known currencies |

| 2. | Fast money transfers, with half of all transactions completed in minutes and the rest within 0-2 days | Less-frequented countries and currencies might incur high transfer fees |

| 3. | Ideal for small transactions | Challenges with customer service |

| 4. | Comprehensive global service reach | Cash pickups aren’t an option |

| 5. | Diverse payment methods encompassing bank accounts, debit and credit cards, PayPal, and more | Inadequate for large monetary transfers |

| 6. | Widespread local presence with branches in more than 28 countries | Lack of dedicated currency dealers |

| 7. | Custom quotes are available without signup | |

| 8. | Outstanding web platform and mobile app experience | |

| 9. | Highly rated on Trustpilot | |

| 10. | Impressive currency support (over 50 currencies) | |

| 11. | In-depth knowledge repository |

- Founded: 2011

- Headquarters: London, UK

- Trading Highs: Let’s kick things off with Wise, the LeBron James of money transferring. They’re slam-dunking an annual trading volume of £76.4 billion as of 2022. Those aren’t just stats – they’re bragging rights;

- Trustpilot Rating: If you’re someone who looks at reviews the way you look at the menu at a new restaurant, then Wise is your Michelin-starred option. A Trustpilot rating of 4.5 out of 5 is like the popular kid in school who everyone trusts with their locker combination;

- Client Count: Sixteen million clients can’t be wrong, can they? That’s right, 16 million – enough to fill 400 Amsterdam Arenas! Wise’s team of 4,500 employees are like the pit crew at a Formula 1 race: expertly skilled and laser-focused on client satisfaction;

- Global Reach: Wise has already planted its flag in over 170 countries and deals in more than 50 currencies. No passport required – just hop on board their digital express and you’re good to go;

- Transfer Limits: Whether you’re trying to impress your date by covering the dinner tab or you’re splurging on a rare Van Gogh piece, Wise has got you. Transfer limits from a mere €1 to an astonishing €6,000,000 let you flex as hard or as soft as you like;

- Fees and Rates: Fees – the dread of every transaction. But with Wise, you can breathe easily. Their fixed fees are as low-key as a Dutch cyclist in Amsterdam – ranging from €0.2 to €2. They also have a variable fee that’s quite chill, floating between 0.4% and 0.6%. And talk about transparency – they offer mid-market rates, making sure you don’t get fooled by any sleight-of-hand currency conversion tricks;

- How to Send and Receive: Wise is so user-friendly that even a senior citizen could initiate money transfers through their web or mobile platform. Users can use their bank accounts, debit/credit cards, or Apple/Google Pay to fund their transactions. The money lands in the recipient’s Wise account, ready for the next move;

- Language Support: Wise speaks over 15 languages, enough to win Eurovision in communication, hands down. Those include English, Spanish, Portuguese, Russian, French, German, Polish, Japanese, Chinese, Italian, Romanian, Indonesian, Hungarian, Ukrainian, and Turkish. As you can unfortunately notice, Dutch isn’t on their list of languages yet;

- Regulatory Approval: Safety alert: Wise is like Fort Knox meets James Bond. Endorsements from the National Bank of Belgium, the UK Financial Conduct Authority, and even the Financial Crimes Enforcement Network in the USA make it a bulletproof choice for even the most reluctant senders;

- Mobile App: Imagine transferring money while sipping a margarita on the beach. Yeah, there’s an app for that. Wise’s mobile app is the digital butler you’ve always wanted, and its 4.7 out of 5 rating in both Android and iOS stores confirms it’s doing something right;

- The Trophy Cabinet: Wise isn’t just collecting participation ribbons – they’re stacking trophies. Best European Startup? Done. Consistent feature on the FinTech50 list? Check. We bet that their office perks probably win awards as well;

- Customers’ Opinion: Now, let’s keep it real. Wise is amazing, but it’s not infallible. There’s some chatter about document requirements, delayed transfers, and not-so-stellar customer service moments. A few grumbles here and there do pop up about deactivated accounts and inaccessible funds. Nobody’s perfect, but Wise is like the Beyoncé of money transfer companies – largely flawless but not without critics. That comes as no wonder as they’re packed with more features than a Swiss Army knife and enough accolades to make anyone seriously consider them as their preferred choice.

Read our full Wise review.

2. XE

| Pros | Cons | |

|---|---|---|

| 1. | Extensive global reach | Absence of dedicated account managers for all users |

| 2. | Stellar customer service | Average Trustpilot rating |

| 3. | Handy exchange rate alerts feature | No solid cancellation policy in place |

| 4. | Attractive exchange rates | Sparse coverage of less-common currencies |

| 5. | Local presence in many locations worldwide | Small transfer fees are imposed on certain small money transfers |

| 6. | Loads of experience under the belt | |

| 7. | Broad currency selection | |

| 8. | Swift money transfers with 50% transfers processed within minutes | |

| 9. | Provides cash pickup service | |

| 10. | Offers instant custom quotes | |

| 11. | A variety of payment methods |

- Founded: 1993

- Headquarters: Newmarket, Ontario, Canada

- Trading Highs: If Wise is the LeBron of money transfers, then XE is the Tim Duncan – no flash, all substance. With an annual trading volume of a whopping £115 billion, it’s clear that XE isn’t in the playground but in the big leagues;

- Trustpilot Rating: Sure, XE doesn’t have a trophy cabinet like a Hollywood star, but don’t sleep on them. With a 4.3 out of 5-star Trustpilot rating, they’re the Tom Cruz of money transfers – even without an Oscar, everyone respects him, and you should too;

- Client Count: Boasting around 150,000 annual clients and pulling in 280 million online eyeballs, they’re the regular favorite everyone keeps going back to;

- Global Reach: Feeling a little international? XE’s got you covered in nearly every corner of the globe. Serving up financial solutions in over 170 countries, they’re more versatile than a Swiss Army knife at a camping trip;

- Transfer Limits: XE is as flexible as they come. Whether you’re sending just €1 or a cool €350,000 within the EU, XE rolls with it;

- Fees and Rates: XE has a fee structure that’s as easy to understand as a children’s book. For smaller European transactions, there’s a nominal fee. But go over £250 in the UK or €250 in Spain, and it’s goodbye, fees! Outside Europe, you can forget about extra charges. XE’s exchange rates are about 0.2% to 1.4% above the mid-market exchange rate, which is pretty darn fair;

- How to Send and Receive: When it comes to sending money, XE offers more options than a deluxe sushi platter. Bank accounts, direct debit, cards, PayID, Interac – you name it. When you’re on the receiving end, you’ve got options too: snag your cash online or from one of their gazillion (read: half-a-million) global pick-up spots;

- Language Support: Not an English speaker? No problem. XE is multilingual in a way that would make the UN proud, supporting a myriad of languages, including English, French, Swedish, Spanish, German, Portuguese, Italian, Japanese, Arabic, and Chinese;

- Regulatory Approval: If you’re looking for a money transfer service that’s got more seals of approval than a beach in California, look no further. With oversight from heavy-hitters like the FinCEN in the US, OSFI, FINTRAC in Canada, FCA in the UK, and ASIC in Australia, XE is as secure as a bank vault with a biometric lock;

- Mobile App: The app game at XE is solid, hitting 3.5/5 on Android and 4.3/5 on iOS. Whether you’re tracking transfers or setting up exchange rate alerts, their app is the equivalent of having a financial control center right in your pocket;

- The Trophy Cabinet: Okay, they may not have a hardware store in their office, but XE snagged the Canstar’s International Money Transfers Outstanding Value Award in 2021. Clearly, they don’t need a trophy room when they’ve got an award that speaks volumes;

- Customers’ Opinion: In the court of public opinion, XE is that reliable friend who always remembers your birthday. Sure, there are minor complaints about higher rates and customer service, but with over 50,000 recommendations singing their praises, those niggles are like a single raindrop in an ocean. That solidifies the impression that XE is the strong, silent type of money transfer company – less swagger and more substance.

Read our full XE review.

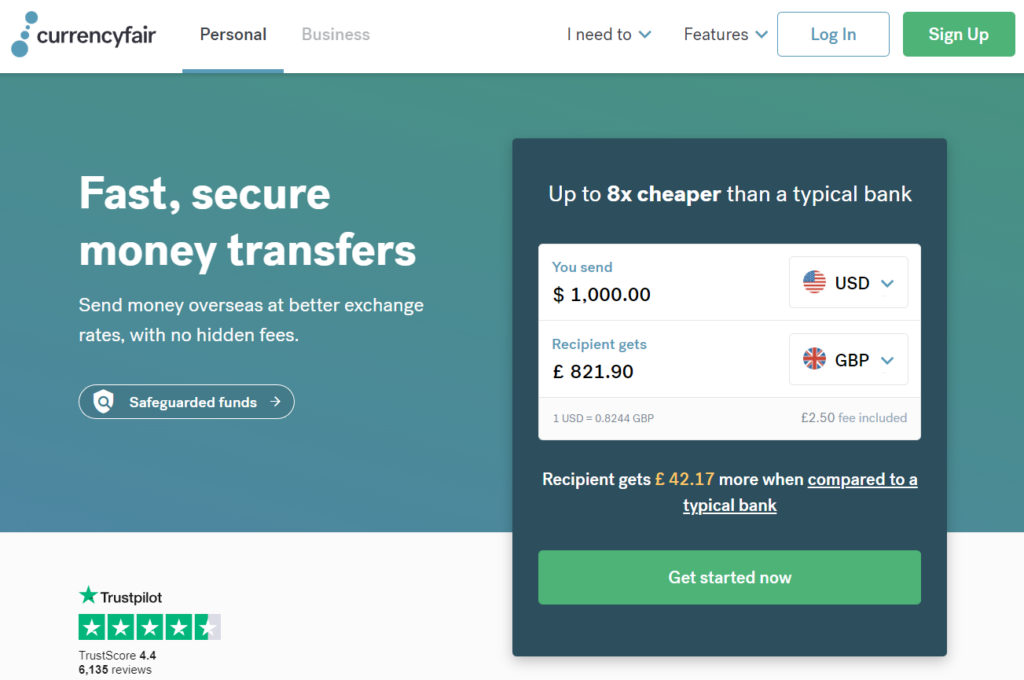

3. CurrencyFair

| Pros | Cons | |

|---|---|---|

| 1. | Impressive Trustpilot score | Absence of cash pickup service |

| 2. | Awards for superb performance in the financial sector | Poor user rating for the Android mobile app |

| 3. | Adequate for both large and small money transfers | Lack of personal account managers for individual users |

| 4. | Instant personalized quotes | Limited options for transfer funding |

| 5. | Fixed fee for money transfers | Narrow range of supported currencies |

| 6. | Wide-reaching service coverage | |

| 7. | Competitive exchange rates | |

| 8. | Alerts for exchange rate changes | |

| 9. | Quick international transfers | |

| 10. | Excellent customer service |

- Founded: 2009

- Headquarters: Dublin, Ireland

- Trading Highs: With an annual trading volume of $300 million, they might not be the heavyweight champion, but they’re undoubtedly a scrappy contender that packs a punch;

- Trustpilot Rating: CurrencyFair doesn’t just talk the talk, they walk it too, with a dazzling 4.4 out of 5 stars on Trustpilot. Clearly, their reputation is as sparkling as a freshly polished diamond;

- Client Count: Boasting 150,000 business and personal clients, CurrencyFair isn’t playing any games. This kind of crowd makes for a standing ovation for a job well done;

- Global Reach: While not as widespread as XE, CurrencyFair still stamps its passport in over 150 countries. They may offer “only” around 20 currencies, but as they say, sometimes less is more;

- Transfer Limits: In the game of financial limbo, CurrencyFair goes both high and low. With a rock-bottom minimum transfer limit of just €10 and a ceiling that reaches up to a staggering 10 million in supported currencies, they’re the financial limbo champion;

- Fees and Rates: Speaking of clarity, CurrencyFair’s fee structure is as straightforward as a laser beam – just €3.00 per transfer. And their exchange rate markup? A modest 0.45% which is added to the mid-market exchange rate. That’s what you call ultimate transparency;

- How to Send and Receive: If you’re all about cutting through the red tape, CurrencyFair is your go-to. They support Bank-to-bank transfers only and no other options. Plus, their mobile app gives you financial freedom whether you’re exploring the Amsterdam canals or enjoying a cup of tea in a tulip field;

- Language Support: Although they only offer support in German, English, and French, it’s quality over quantity. Unfortunately for the Dutch speakers among us, you might have to wait a bit longer for inclusion;

- Regulatory Approval: With regulatory endorsements from the likes of the Central Bank of Ireland to the Monetary Authority Singapore (MAS), rest assured that your money is in a bank vault level of safety with CurrencyFair;

- Mobile App: Now here’s where things get interesting. CurrencyFair’s mobile app scores a mercurial 2.6/5 on Google Play but a robust 4.4/5 on the App Store. Android users, keep those fingers crossed for an update soon;

- The Trophy Cabinet: Don’t let their underdog status fool you. CurrencyFair has some notable silverware in the cabinet. Named a “Top 100 Startup to Watch in 2018” by Silicon Republic and winning “Best in Fintech” at the 2019 Spiders Awards, they’re the dark horse that swipes the finish line to everyone’s surprise;

- Customers’ Opinion: While CurrencyFair gets a standing ovation for its low fees and competitive exchange rates, it’s not without its weak points. A few hiccups in customer service and account verification might make you pause, but these are minor quibbles in an otherwise strong offering. CurrencyFair is the understated yet agile contender in the money transfer ring, so if you’re looking for a straightforward, no-nonsense option with competitive fees and rates, your search might just end here.

Read our full CurrencyFair review.

4. Western Union

| Pros | Cons | |

|---|---|---|

| 1. | Diverse payment methods | High markups on exchange rates |

| 2. | Fee and rate prediction tool | Not optimal for substantial money transfers |

| 3. | Exceptional convenience | Elevated transaction fees |

| 4. | Comprehensive information repository | Absence of hedging options for businesses |

| 5. | Availability of cash pickup locations | |

| 6. | Excellent mobile application | |

| 7. | Rapid fund transfers | |

| 8. | Beneficial rewards scheme | |

| 9. | An abundant industry experience | |

| 10. | Worldwide service reach | |

| 11. | Robust currency handling | |

| 12. | High rating on Trustpilot |

- Founded: 1851

- Headquarters: Denver, CO, United States

- Trading Highs: Western Union is an industry titan that’s been slam-dunking in the money transfer world for ages. In 2017, they were orchestrating a jaw-dropping 32 transactions per second and pushing a monumental $300 billion around the globe, capturing more than 20% of the international transfer market;

- Trustpilot Rating: With a 3.9 out of 5-star rating on Trustpilot, Western Union shows they’re still a force to be reckoned with. Like a seasoned athlete, they’ve got their moves honed to give you a strong and steady service;

- Client Count: With a staggering 150 million customers served annually, Western Union’s reach surpasses all the rest of its competitors;

- Global Reach: When talking about global influence, Western Union has a nearly omnipresent reach. With 550,000 agents worldwide and support for around 130 currencies, you could send money to a rock in the Atlantic if you wish (though Iran and North Korea are off-limits for evident reasons);

- Transfer Limits: Flexibility is the name of the game here. Whether you’re transferring small amounts or up to $50,000, Western Union has you covered. No minimums to worry about, and if you’re keeping things under $3,000, you can even go ID-free;

- Fees and Rates: Western Union’s fee structure is a bit of a mixed bag. Costs can range from the price of a cup of coffee to a high-end dinner ($0-$15 on average, but can spike up to $100). The exchange rates carry a markup between 1% and 5% (above the mid-market exchange rate), but they’re often still a better deal compared to traditional banks;

- How to Send and Receive: Sending money can be done through a myriad of options – bank transfers, credit cards, or good old cash. Receiving funds is even available as a pickup option (in person), or the standard of having the funds deposited into billions of bank accounts and mobile wallets globally;

- Language Support: No matter what language you speak, Western Union probably speaks it too. From Dutch and German to the likes of Finnish and Japanese, they’ve got a polyglot squad ready to assist;

- Regulatory Approval: Safety is non-negotiable for Western Union. They’re vetted by heavyweight regulatory bodies like FCA in the UK, FINTRAC in Canada, AUSTRAC in Australia, and have received approvals from 49 states and DC in the US;

- Mobile App: Western Union’s mobile apps are anything but second-tier. Whether you’re team iOS or Android, moving money becomes as easy as a swipe and a tap on your device;

- The Trophy Cabinet: Western Union is no rookie when it comes to accolades. With a trophy cabinet boasting recognition for innovation in payments and notable humanitarian efforts, they’re not just players but established MVPs;

- Customers’ Opinion: Western Union is the seasoned pro of the money transfer game – reliable, expansive, and versatile. The customer consensus on their service is overwhelmingly positive. Quick transfers, a plethora of options, and global reach are often highlighted as standout features. The downsides consist of a few complaints about steeper fees and occasional customer service blips. However, the general sentiment is that the pros heavily outweigh the cons.

Read our full Western Union review.

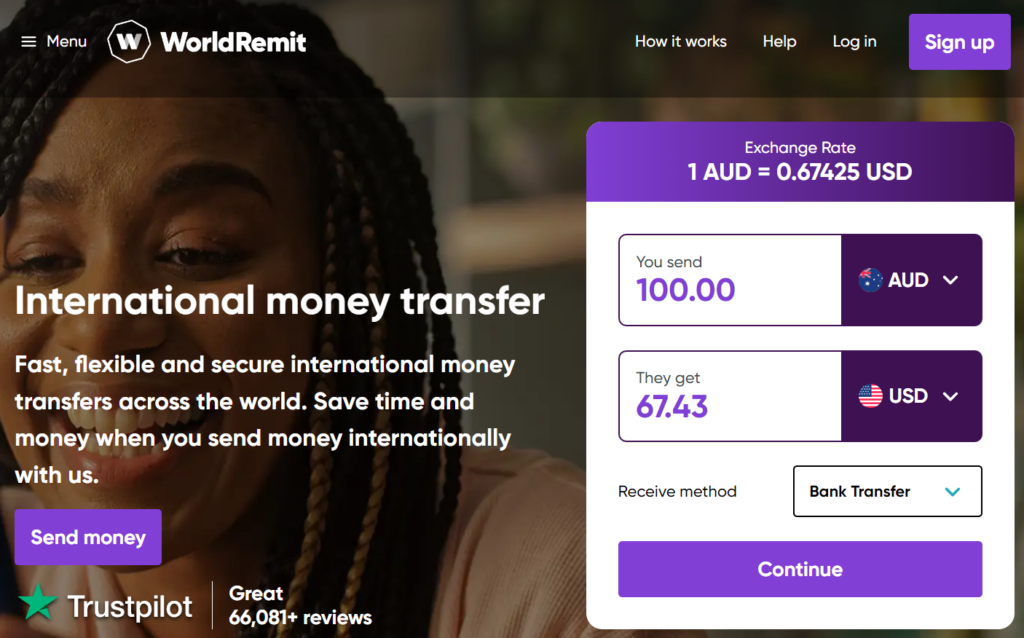

5. WorldRemit

| Pros | Cons | |

|---|---|---|

| 1. | Mobile digital wallet features | No personal account managers available |

| 2. | Comprehensive and informative knowledge base | Lacks business solutions like forward contracts and limit orders |

| 3. | Instant, personalized cost estimates | Not ideal for transferring large sums of money |

| 4. | Excellent policy for transfer cancellations | Numerous criticisms pertaining to customer service |

| 5. | Swift funds transfers | |

| 6. | An abundance of payment methods | |

| 7. | Wide local presence with offices in 15 nations | |

| 8. | Strong coverage of over 70 unique currencies | |

| 9. | Small transaction fees | |

| 10. | Cash pickup services available | |

| 11. | Comprehensive global service availability | |

| 12. | Competitive foreign exchange rates |

- Founded: 2010

- Headquarters: London, UK

- Trading Highs: WorldRemit is far from your run-of-the-mill money transfer service. They are a juggernaut that’s slaying the game. The stats speak for themselves: approximately 1.5 million transactions a month and a yearly turnover of $10 billion. Oh, and let’s not forget a 2021 revenue that’s a hair away from the $400 million mark;

- Trustpilot Rating: With a Trustpilot score averaging 3.9 stars and over 70,000 reviews, WorldRemit is a crowd-pleaser, drawing attention like a seasoned pro;

- Client Count: WorldRemit has pulled in an impressive 5.7 million customers and counting. In the world of money transfers, that’s not just a number – it’s a movement;

- Global Reach: WorldRemit’s global reach is nothing short of spellbinding. Operating in 50 countries and extending its services to 145 destinations, they have a special focus on Africa, allowing money transfers to happen smoothly with over 70 currency options;

- Transfer Limits: Whether you’re sending pocket change or making it rain, WorldRemit has got a spot reserved just for you. Their transfer limits are pretty accommodating, ranging from $1,400 up to a hefty $60,000. The one caveat is that these limits can fluctuate based on your destination and currency;

- Fees and Rates: In terms of fees, WorldRemit keeps it minimalistic – we’re talking a measly $0.99 to $3.99. Coupled with a modest markup of 1% to 1.6% above the mid-market rate, they’re essentially leaders in the affordability market;

- How to Send and Receive: Variety is the spice of life, and WorldRemit offers a full buffet. From bank transfers to Apple Pay, POLi, and Klarna, the choice is yours. As for the recipients, they can receive funds directly into their bank accounts, mobile wallets, pick it up in person, or even get it delivered to their doorstep;

- Language Support: Navigating the WorldRemit platform is a cinch, regardless of your preferred language. Options include Dutch, Spanish, English, Danish, and German;

- Regulatory Approval: When it comes to regulatory compliance, WorldRemit has a roster that would make anyone green with envy. We’re talking about approvals from the National Bank of Belgium, the FCA in the UK, FinCEN in the US, FINTRAC in Canada, AUSTRAC in Australia, FSA, and so on;

- Mobile App: Their mobile app isn’t just functional. It’s exceptional! With soaring ratings of 4.7 and 4.8 on Google Play and the App Store, respectively, it’s evident that users are more than satisfied with their WorldRemit mobile experience;

- The Trophy Cabinet: WorldRemit’s awards aren’t just shiny baubles. They’re bona fide stamps of approval from institutions as prestigious as the United Nations, Deloitte, the Sunday Times, and even the BBC;

- Customers’ Opinion: On the whole, WorldRemit scores high marks for its user-friendliness, affordability, and transparency. While a few users have noted longer wait times on customer support or occasional transfer delays, the choir of praise overwhelmingly drowns out the naysayers. So, if you’re looking for a service that doesn’t just crunch numbers but connects the world, one transaction at a time, then WorldRemit might just be your go-to.

Read our full WorldRemit review.

6. OFX

| Pros | Cons | |

|---|---|---|

| 1. | Robust currency options | Not ideal for transferring small amounts |

| 2. | Swift money transfers within 1-3 days | Transfer fees apply for amounts less than $10,000 |

| 3. | Exceptional mobile app user experience | Absence of instant custom quote feature |

| 4. | Adaptable solutions tailored for businesses | Limited options for funding transfers |

| 5. | Broad international service coverage | |

| 6. | Outstanding customer support | |

| 7. | Comprehensive FAQ resources | |

| 8. | Attractive currency exchange rates | |

| 9. | Generous transfer cancellation policy | |

| 10. | Option for setting up exchange rate alerts |

- Founded: 1998

- Headquarters: Sydney, New South Wales, Australia

- Trading Highs: We’re not talking chump change here. OFX has handled a jaw-dropping $140 billion in global money transfers since inception. This financial titan reports a net income of around $100 million and holds over $60 million in net cash. Simply put, OFX isn’t just playing the game – they’re changing it;

- Trustpilot Rating: Feast your eyes on a sparkling 4.3 out of 5 Trustpilot stars, mostly thanks to their corporate clientele. This puts them up there with the heavy hitters of the money transfer world, and it’s clear the business crowd is singing their praises;

- Client Count: With over a million customers in their roster, OFX may not be the biggest fish in the sea, but they sure are one of the most substantial. They’re the go-to for larger-than-life transfers, and if size matters to you, OFX won’t disappoint;

- Global Reach: Boasting an impressive reach across more than 190 countries and supporting 55 currencies (with 5 recent additions), OFX is like the international food court of money transfers. No matter where you’re sending or receiving from, chances are OFX has got you covered;

- Transfer Limits: Minimum transfer amounts vary by region, but there’s no cap on the maximum. So, whether you’re sending a small care package or funding an overseas venture, OFX is as flexible as they come;

- Fees and Rates: Here’s the kicker: If you’re transferring more than $10,000, the transfer is free. For smaller amounts, fees vary but still remain competitive. And their mid-market rate margins range from 0.4% to 1.9%, making them a solid pick in the “bang-for-your-buck” department;

- How to Send and Receive: OFX has a slick online platform and an app that even your tech-averse grandparent could navigate. Just remember, bank accounts are the alpha and omega for both sending and receiving funds;

- Language Support: This aspect is a bit of a downside for OFX. They’ve got English-only support on their platform and app. But if you’re reading this article, we’re guessing that’s a non-issue for you;

- Regulatory Approval: OFX operates under a symphony of over 50 global financial regulators, including some high-brow names like the Central Bank of Ireland and ASIC in Australia. So, you can sleep easy knowing your money’s in safe hands;

- Mobile App: Their mobile app doesn’t just sit in the backseat. It’s co-piloting this venture. With a 4.9 rating on the App Store and 4.6 on Google Play, it’s clear that their app isn’t just an afterthought but a front-runner;

- The Trophy Cabinet: OFX isn’t new to the limelight. Their accolades include spots on Deloitte’s Fast 50 and Fast 500 Asia Pacific, not to mention being crowned Best International Money Transfer Provider by the Finder Customer Satisfaction Awards;

- Customers’ Opinion: Reviews tell us that OFX’s robust performance and killer customer service make it a fan favorite. While a few naysayers point out longer transfer times and documentation hurdles, the applause drowns out the boos. That being said, OFX has proven itself as a top dog, especially for businesses looking to make larger transactions. When it comes to sending your cash across borders, you could do a lot worse if you choose the wrong service. So, if you’re looking to make some serious financial moves, OFX should be on your radar.

Read our full OFX review.

7. Revolut

| Pros | Cons | |

|---|---|---|

| 1. | Virtual cards for secure online transactions | Complex fee structure |

| 2. | Comprehensive suite of business-oriented features | Inefficient for large-scale money transfers |

| 3. | Wide range of supported currencies for travelers | No cash pickup options |

| 4. | Attractive foreign exchange rates | A relative newcomer in the financial industry |

| 5. | Exceptional customer support | Limited scope of in-app currency support |

| 6. | An abundance of contemporary banking features | |

| 7. | Zero transfer fees for smaller transfers | |

| 8. | User-friendly debit card services | |

| 9. | Fast money transfers | |

| 10. | Option to trade in cryptocurrencies | |

| 11. | Broad coverage of services globally |

- Founded: 2015

- Headquarters: London, UK

- Trading Highs: Revolut facilitated an eye-popping $140 billion in transactions just in 2022. Let that sink in for a moment. This fact alone makes Revolut more than your everyday fintech. They’re a customer trust powerhouse now;

- Trustpilot Rating: Sporting a robust 4.3 out of 5 on Trustpilot, Revolut isn’t just talking the talk. Customers are loving what this innovative money maestro brings to the table;

- Client Count: With a jaw-dropping 30 million individual users and over 500,000 businesses under its belt, Revolut isn’t just a service but a full-blown community. Trust us, they’re doing a lot right;

- Global Reach: This is globalization at its finest. Available in over 200 countries with an arsenal of 29 in-app currencies and withdrawals in 140 global currencies, Revolut’s like your financial passport to the world;

- Transfer Limits: Revolut offers you the kind of freedom usually reserved for bald eagles and superheroes. No minimums and varying maximums based on your specific plan and country mean you’re always in the driver’s seat;

- Fees and Rates: Let’s get down to brass tacks: fees range based on transaction types and when you make them. Inside Europe, card transfers will set you back by just 0.7%. Outside Europe, it’s 2.3%. Bank transfers are in the ballpark of 0.35% to 1%, and weekdays are your friend if you’re transferring under $1,000 since there’s no markup. Over that, or on weekends, expect a markup between 0.5% and 2% added to the mid-market exchange rate;

- How to Send and Receive: Revolut makes sending and receiving money as straightforward as tapping your phone screen. With bank accounts, debit, and credit cards as options for initiating transfers, your funds can land either directly on your card or in your bank account;

- Language Support: Revolut isn’t just for the English speakers among us. They’re fluent in multiple languages, including (but not limited to) Dutch, Spanish, Greek, French, Swedish, Chinese, Croatian, and Russian;

- Regulatory Approval: Rest easy, as Revolut operates under the watchful eyes of top-tier regulatory bodies like the Bank of Lithuania and the UK’s FCA. Your money with Revolut isn’t just safe – it can’t be stolen even by hacking experts;

- Mobile App: Their mobile app is a dream for both form and function, scoring a 4.7 on iOS and a 4.5 on Android. It’s like having a financial advisor doing everything for you right in your pocket;

- The Trophy Cabinet: Revolut’s already got a shelf full of trophies, nabbing awards for “Innovation of The Year” and “Best FinTech Employer of the Year,” among others. These accolades prove they’re not just in the game but that they’re dominating it;

- Customers’ Opinion: Despite a couple of grumbles about occasional glitches and some peak-time customer service delays, the people have spoken: Revolut is a fintech marvel. Whether you’re an individual globetrotter or a business honcho, Revolut caters to your every financial whim. So, if you’re looking for a money transfer option that’s as dynamic as it is dependable, Revolut should be at the top of your list. They’re not just setting the standard – they’re redefining it.

Read our full Revolut review.

8. MoneyGram

| Pros | Cons | |

|---|---|---|

| 1. | Beneficial loyalty rewards program | Above-average exchange rate markups |

| 2. | Outstanding customer support | A possibility of substantial transfer fees |

| 3. | Extensive global presence, covering over 200 countries and territories | Limited maximum transfer amounts |

| 4. | Availability of cash pickup | Less ideal for handling large financial transfers |

| 5. | Impressive rating on Trustpilot | Lack of hedging options for businesses |

| 6. | A vast range of payment methods | |

| 7. | A top-rated mobile application | |

| 8. | Robust currency portfolio including 58 different currencies | |

| 9. | Extensive industry experience | |

| 10. | Swift money transfer services | |

| 11. | Diverse options for receiving funds |

- Founded: 1940

- Headquarters: Dallas, Texas, US

- Trading Highs: MoneyGram’s lips are sealed when it comes to exact transaction figures, but a staggering 2022 revenue of $1.3 billion screams “heavy hitter” in all caps. That alone proves that they’re not just in the money game but actively shaping it;

- Trustpilot Rating: They’ve got a rock-solid 4.5-star rating on Trustpilot. That’s not only a rating but a testament to MoneyGram’s knack for keeping customers thrilled;

- Client Count: Talk about a following! MoneyGram has won the trust of 150 million folks over the past five years. That’s an entire fanbase of loyal customers;

- Global Reach: This company has more locations than your favorite fast-food chain. With 380,000 spots across 200-plus countries and support for around 60 currencies, MoneyGram is basically the Google Maps of money transfer services;

- Transfer Limits: Freedom’s the name of the game. No minimum limits and maximum online transfers ranging from €10,000 for most countries to $25,000 for some hotspots like Spain. With MoneyGram, it’s basically “your money, your rules”;

- Fees and Rates: You’ll find a huge variety of fees depending on, well, a lot – ranging from zero to about $100. They’re a tad pricier than their younger competitors, with rates sitting between 1% and 5% over the mid-market, but hey, you’re paying for top-notch service that’s been crafted and refined for almost a century;

- How to Send and Receive: MoneyGram is the all-in-one money transfer service. You can pick from bank accounts, credit cards, cash – whichever you prefer. On the flip side, you can scoop up your dough through bank accounts, debit cards, mobile wallets, or a good ol’ cash pickup. Some spots even offer door-to-door delivery;

- Language Support: MoneyGram has a whole United Nations vibe going on with language support. We’re talking about everything from Spanish and Romanian to Chinese and Korean. They’re truly everyone’s best friend;

- Regulatory Approval: Worried about security? Don’t stress. With big names like the UK’s Financial Conduct Authority and Canada’s FINTRAC in their regulatory corner, MoneyGram’s got your back even when you’re not thinking about it;

- Mobile App: Their mobile app is like that cool new gadget you can’t help but brag about – sporting a 4.9 on iOS and a 4.7 on Android. It’s truly more of a pocket-sized financial command center than a simple mobile app;

- The Trophy Cabinet: This isn’t MoneyGram’s first rodeo, and they’ve got the silverware to prove it. With accolades like the PYMNTS Innovator Awards and a spot on The Dallas Morning News’s Top 100 Places to Work, they’re clearly doing more than a few things right;

- Customers’ Opinion: The people have spoken, and they’re mostly singing praises. Think speed, efficiency, and user-friendliness. Sure, there’s chatter about higher fees and some glitchy moments, but the overall consensus is that MoneyGram’s reliability makes it worth every penny. All of that means that, if you’re looking for a transfer option that’s as universal as it is trusted, MoneyGram should be high on your radar.

Read our full MoneyGram review.

9. Remitly

| Pros | Cons | |

|---|---|---|

| 1. | Excellent customer service | Doesn’t provide dedicated account managers |

| 2. | Plenty of ways to fund your transfer | Exchange rates can sometimes be substantial |

| 3. | Decent Trustpilot rating | No option for instant custom quotes |

| 4. | Top-tier mobile app | Not great for large money transfers |

| 5. | Instantaneous money transfers | |

| 6. | No minimum transfer limit when sending | |

| 7. | Worldwide locations for cash pickup | |

| 8. | Fixed transfer fees | |

| 9. | Extensive global coverage | |

| 10. | A knowledge base that’s a treasure trove of info | |

| 11. | Deals with a heap of currencies |

- Founded: 2011

- Headquarters: Seattle, WA, USA

- Trading Highs: In 2021, Remitly orchestrated a monumental $20.4 billion in transactions, coupled with a revenue of $458.6 million. This is really more than just a number. It’s a declaration of Remitly’s rapid ascendancy in the financial world;

- Trustpilot Rating: Remitly rides high with a 4.1-star Trustpilot rating, garnered from nearly 40,000 reviewers. That’s more of an endorsement than it is a metric, certifying Remitly as a trusted player in the money transfer ecosystem;

- Client Count: With a growing tribe of over 3 million active customers, Remitly isn’t just another face in the crowd. It’s the one you remember – the one you trust;

- Global Reach: Don’t let Remitly’s 28 sending countries fool you. The company has a reach that spans a staggering 180 countries and supports 75 currencies. Some of which, mind you, you’ve probably never heard of. Truly, Remitly is making the world a smaller place, one transfer at a time;

- Transfer Limits: Whether you’re sending a sentimental dollar or a life-changing amount, Remitly has got your back. Transfer limits oscillate between $3,000 and $150,000, pivoting on variables like destination and currency type;

- Fees and Rates: With transfer fees as low as zero and peaking at $50, most users find themselves in the modest $3.00-$7.00 range. As for the exchange rates, Remitly typically tags them at 1%-2.5% over the mid-market rate, although they can sometimes swing as low as 0.5% or as high as 3.7%;

- How to Send and Receive: Whether you’re loyal to your bank account or a credit/debit card enthusiast, Remitly offers an array of sending options. As for collecting your cash, Remitly flexes its versatility muscles with choices ranging from bank deposits and cash pickups to mobile wallets and even home deliveries;

- Language Support: No matter your linguistic preference, Remitly has you covered with its platform and customer support available in 15 different languages: Dutch, English, French, German, Polish, Italian, Portuguese, Romanian, Vietnamese, Turkish, Filipino, Thai, Chinese, and Korean;

- Regulatory Approval: You can rest easy as Remitly is watched over by a host of regulatory bigwigs including the U.S. Department of the Treasury, the Central Bank of Ireland, and Canada’s FINTRAC. Your money with them is simply in good, trusted hands;

- Mobile App: Rated an eye-popping 4.8 on Google Play and 4.9 on the App Store, Remitly’s mobile app makes transfers as easy as a swipe and a tap;

- The Trophy Cabinet: From being anointed “Startup of the Year” in 2016 to gracing Forbes’ FinTech 50 list in 2019, Remitly has a trophy case that would make even the most seasoned competitors green with envy;

- Customers’ Opinion: The user sentiment around Remitly largely tells a tale of rapid transfers, a hassle-free interface, and competitive fees. Though the Trustpilot score points to a few customer service and tech issues, these are exceptions, not the norm. With that, Remitly proves they’re not just another money transfer service but a fully realized financial companion for the modern age. With its focus on customer satisfaction and regulatory compliance, Remitly is setting the gold standard for what a 21st-century money transfer service should be.

Read our full Remitly review.

10. Key Currency

| Pros | Cons | |

|---|---|---|

| 1. | Quick money transfers | Services not accessible for residents in the US |

| 2. | Impressive Trustpilot score | Absence of a mobile app |

| 3. | Stellar customer service | Lack of support for less-common currencies |

| 4. | No limits on transfer amounts | No option for instant personalized quotes |

| 5. | Attractive exchange rates | Not optimal for smaller transfers |

| 6. | Personalized support from dedicated account managers | Limited funding methods |

| 7. | Extensive industry experience | |

| 8. | Zero transfer fees | |

| 9. | Wide-reaching service coverage | |

| 10. | Flexible currency hedging options |

- Founded: 2016

- Headquarters: Truro, Cornwall, UK

- Trading Highs: With an annual trade volume of £2 billion in 2022, Key Currency is no slouch in the money transfer arena. Its sizable volume marks its growing importance in the world of global remittances;

- Trustpilot Rating: Boasting an enviable 4.9 out of 5 stars on Trustpilot, Key Currency sets the bar high in customer satisfaction and quality service;

- Client Count: Growing steadily, Key Currency now counts over 50,000 customers under its wings, a testament to its expanding reach and robust service offerings;

- Global Reach: Though not a worldwide player, Key Currency shows a keen focus on serving the UK, the EU, and Australian markets. It doesn’t accommodate U.S. residents but does offer transactions in 37 different currencies;

- Transfer Limits: Flexibility is Key Currency’s forte. With no lower or upper limits on transfers, it caters to a wide variety of financial needs, whether you’re moving £10 or millions;

- Fees and Rates: Priding itself on a zero-transfer-fee policy for all clients, Key Currency offers impressive value. While exact exchange rate margins aren’t publicly disclosed, our research indicates that they range from a modest 0.2% for transfers above £200,000 to 1% for smaller transactions under £5,000;

- How to Send and Receive: Limited but reliable, Key Currency operates solely through bank accounts for both sending and receiving funds. This streamlined approach may deter some, but it ensures a secure and straightforward transaction process;

- Language Support: Though English is the default language on its platform, Key Currency assigns dedicated agents fluent in multiple European languages, including French, Swedish, Spanish, and Italian, ensuring a smooth communication experience for international clients;

- Regulatory Approval: The service is under the watchful eyes of regulatory heavyweights like the UK’s Financial Conduct Authority, the Bank of Spain concerning the Netherlands and the EU, and the Financial Crimes Enforcement Network in the US, making it a secure choice for your transactions;

- Mobile App: A glaring absence in Key Currency’s offering is a mobile app (the only service on this list lacking one), forcing clients to rely on personal account managers or their online platform for transactions;

- The Trophy Cabinet: For a relatively young service, Key Currency’s awards cabinet is filling up nicely. They’ve been recognized as the Best Currency Provider in 2016 and 2017 by Online Personal Wealth Awards and have consistently held the title of Best Currency Exchange Service from 2016 to 2023 by ADVFN;

- Customers’ Opinion: Clients overwhelmingly appreciate Key Currency’s excellent customer service, personalized touch, competitive exchange rates, and fee-less transfers. While the consensus is positive, there’s room for improvement – most notably, the need for a mobile app and extended service beyond its primary markets of the UK, EU, and Australia. All in all, Key Currency may not offer a one-size-fits-all solution, but for those who fit into its tailored services, it offers an unmatched experience in efficiency, value, and customer care.

Read our full Key Currency review.

Conclusion

Navigating the complex world of international money transfer services can be a daunting task. Whether you’re a seasoned expat, a business owner with international clients, or someone with family abroad, each service offers a unique blend of features, fees, and flexibility to fit your needs.

From giants like MoneyGram with their enormous trading volume and comprehensive global reach, to specialized players like Remitly focusing on cost-efficiency and mobile accessibility, to more bespoke services like Key Currency offering personalized touch, the options in the Netherlands are quite diverse.

Regulatory compliance, customer reviews, and technological capabilities, like mobile apps, offer additional layers of consideration, providing you with the tools you need to make an informed choice.

As a key European hub with a diverse, international population, the Netherlands is uniquely positioned to lead the way in the evolution of money transfer services. Already home to a tech-savvy populace that embraces digital payment solutions, the country is ripe for innovation in this space.

With increasing demand for real-time transfers, lower fees, and more transparent exchange rates, Dutch consumers and businesses alike stand to benefit from advancements in financial technology. As regulatory frameworks continue to evolve in line with these developments, the future of money transfer services in the Netherlands looks promising, offering more streamlined, secure, and cost-effective options for its global citizens.

F.A.Q.

Why did you only focus on these ten money transfer services?

We aimed to provide a well-rounded view by selecting services that excel in different areas, such as transfer speed, global reach, or customer satisfaction among the rest. This isn’t an exhaustive list, but it’s a starting point for those looking to make informed decisions.

How did you determine the trading volume for each service?

The trading volume point is based on publicly available data, such as annual reports and official press releases. They’re intended to give you a sense of the scale and reliability of each service.

Some services have lower Trustpilot ratings than others. Does that mean they’re less reliable?

Not necessarily. A lower Trustpilot rating could be due to a variety of factors, including customer service issues or transfer delays. It’s important to read customer reviews in detail to understand the nuances and to see if the service meets your specific needs.

Why do transfer limits vary so much between services?

Each service caters to a different customer base, with some focusing on larger business transactions and others on smaller, personal transfers. Transfer limits are set according to their target market’s typical needs.

How up-to-date is the information on fees and rates?

The data on fees and rates is accurate as of the time of writing. However, these can change, so it’s advisable to check the most current information on the service’s official website before making a transaction.

How important is regulatory approval?

Extremely important. Regulatory approval ensures that a money transfer service meets specific standards for reliability, security, and transparency. Always look for services that are well-regulated by reputable institutions.

I noticed WorldRemit has a focus on Africa. Are there services that specialize in other regions?

Yes, some services focus more on specific corridors like Asia-Pacific or UK-EU. Always consider the geographic focus if you have specialized transfer needs.

Can I trust the customer opinions cited in the article?

The customer opinions are aggregated from Trustpilot reviews and are representative of the general sentiment towards each service. However, individual experiences may vary, so it’s always good to do your own due diligence.

Is there a “best” money transfer service among those reviewed?

Each service has its own strengths and weaknesses, so the “best” one for you will depend on your unique needs – whether that’s low fees, fast transfers, or a broad global reach. You can notice that we’ve placed Wise at the top of this list, but if you’re looking for a service that has support for Dutch speakers, you might want to give Remitly, Revolut, or Western Union a try.

How often will this article be updated?

We strive to keep our content as current as possible. Expect periodic updates to reflect new data, services, and customer reviews.

Other Useful Guides to the Netherlands

- 2025 Sea Freight Container Shipping Rates To & From the Netherlands

- 29 Best International Moving Companies in the Netherlands

- Moving to the Netherlands? 2025 Living Costs & Relocation Tips

- 21 Secrets About Living In The Netherlands To Know Before Moving

- Moving to the Netherlands from the United States

- Moving to the Netherlands from Bahrain

- Moving to the Netherlands from Dubai and the UAE

- 13 Best Places To Live in the Netherlands

- Moving to the Netherlands from Kuwait

- Moving to the Netherlands from Qatar

- Moving to the Netherlands from South Africa